Why the emerging markets joyride is ending and it’s time for investors to pull back

David Brown says global trade tensions, a stronger US dollar and rising interest rates have hit emerging markets hard

With question marks already raised about the end of the road for the global equity rally, investors are pulling in their horns and peripheral trades like emerging markets are feeling the strain.

Market confidence will progressively worsen the longer the uncertainty persists over Trump’s trade policy intentions. In the worst-case scenario, the present crisis could end up a precursor to a full-blown trade war. Selective tit-for-tat measures between the US and its trade competitors are one thing, but the imposition of sweeping, wholesale sanctions would be a massive game-changer. Emerging markets risk being crushed in the middle.

Emerging markets have piggybacked off a global trade revival which saw annual growth in world export values bouncing back by as much 13 per cent year-on-year by the end of 2017.

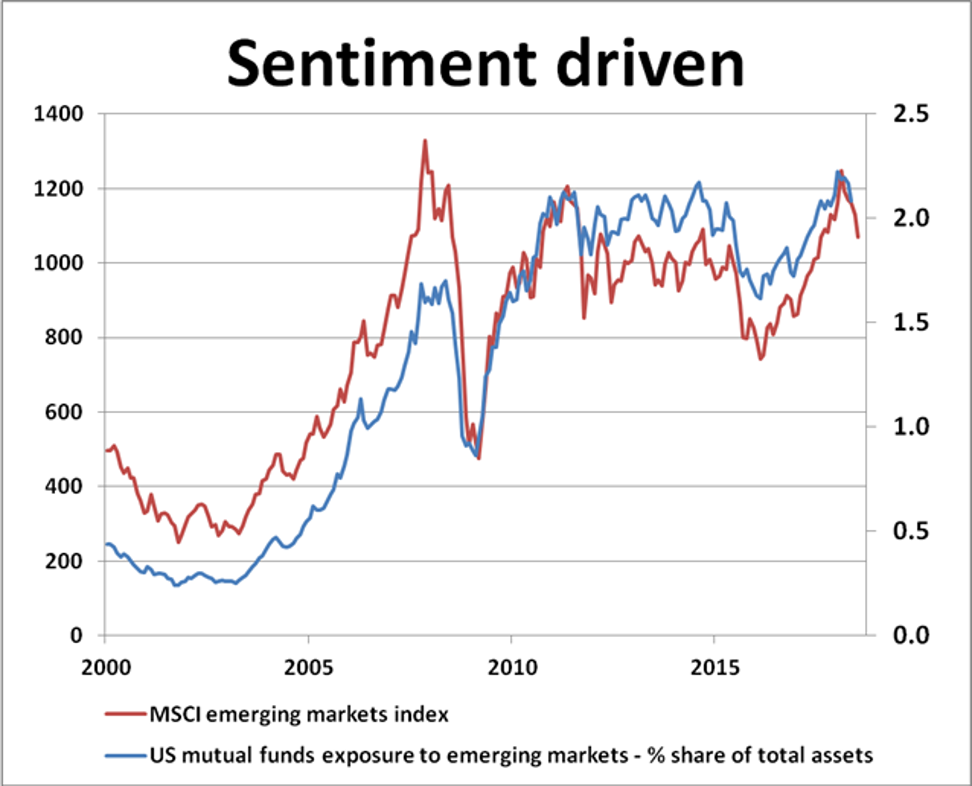

The flood of cheap money generated by global super stimulus cooked up a sumptuous economic recovery, but also channelled a wave of buying into higher risk-return emerging market trades, with investors encouraged by better-looking fundamentals, amid much-improved risk-taking conditions in 2016 and 2017.

Higher US interest rates and bond yields add more pressure to emerging market debt servicing costs

Investors have much to weigh up in the coming months. Quite apart from the specific risks affecting individual markets, there is a welter of systemic problems to deal with, too. Recent rumours that Trump is considering quitting the World Trade Organisation hardly soothe fears about the fallout of his “America first” strategy. If this marks the thin end of the wedge, global economic and investor confidence are due for an even harder shock.

Credit concerns, trade tensions, global monetary conditions and risk aversion must weigh heavily on emerging market flows in the future. If investors start to panic, the impact on emerging market financial stability could be lethal.

The unwinding of high-yield, leveraged carry trades could unfold very quickly. US mutual fund exposure to emerging risk assets remains close to historic highs and could quickly implode. Investors from Europe and Japan would follow suit, compounding the sell-off.

World stock markets have just notched up their worst first-half performance since 2010, so this is no time for investors to gamble any more than they should. The bears are back with a vengeance and emerging market investors should take preventive measures.

David Brown is chief executive of New View Economics