Opinion | How could the global economy crash? Let us count the ways

- Andy Xie says the stock sell-off in the US and elsewhere and the sharp decline in property prices all add up to more debt trouble at a time when debt is already sky-high. A repeat of the global financial crisis of a decade ago seems certain

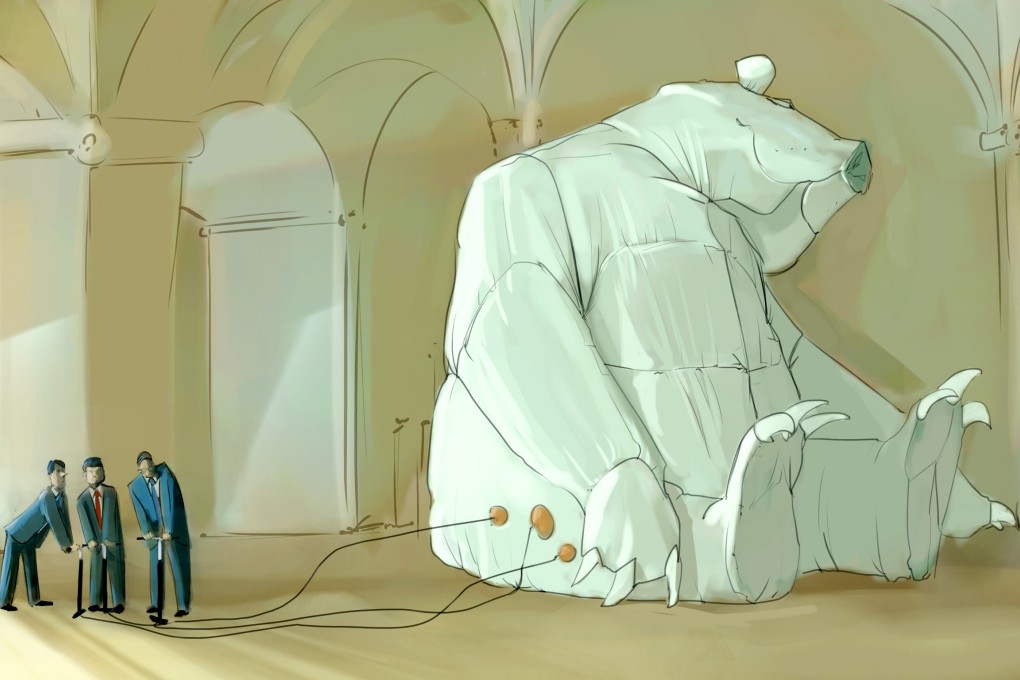

While the debt increase since the 2008 global financial crisis has been driven by securities, a significant chunk of the troubled debt could be sitting on the balance sheets of major banks. A global banking crisis is also possible.

The economic recovery since the financial crisis has been led by debt. All major economies today have higher debt relative to their gross domestic product than 10 years ago. If too much debt was the trigger of the last financial crisis, even more should trigger another.

The sharp decline in asset prices lately suggests that another financial crisis is quite near. The global equity bubble and the property bubble are bursting. Behind them is a gigantic debt bubble. Unless it bursts too, the asset bubbles could build up again on more borrowing. Since 2008, surging asset prices have gone through a few reversals. Yet they kept rising because the debt bubble kept expanding.

Stocks and property have become bubbles because of the easy availability of debt. America’s corporate debt has doubled since 2008, mainly for buying back stocks. That is the source of the US stock market.

Meanwhile, in Australia, the housing bubble came back after 2008 because the debt was there to push its household debt to 200 per cent of disposable income, from 160 per cent.

The start-up economy has also become a big bubble because start-ups with big valuations made up by a few people could borrow loads of money to subsidise their losses.