Advertisement

The View | How will China walk the tightrope between stimulating growth and the need to rein in debt?

Nicholas Spiro says the recent strains on China’s economy have not entirely spooked investors, but the country has a tough economic balancing act to perform

Reading Time:3 minutes

Why you can trust SCMP

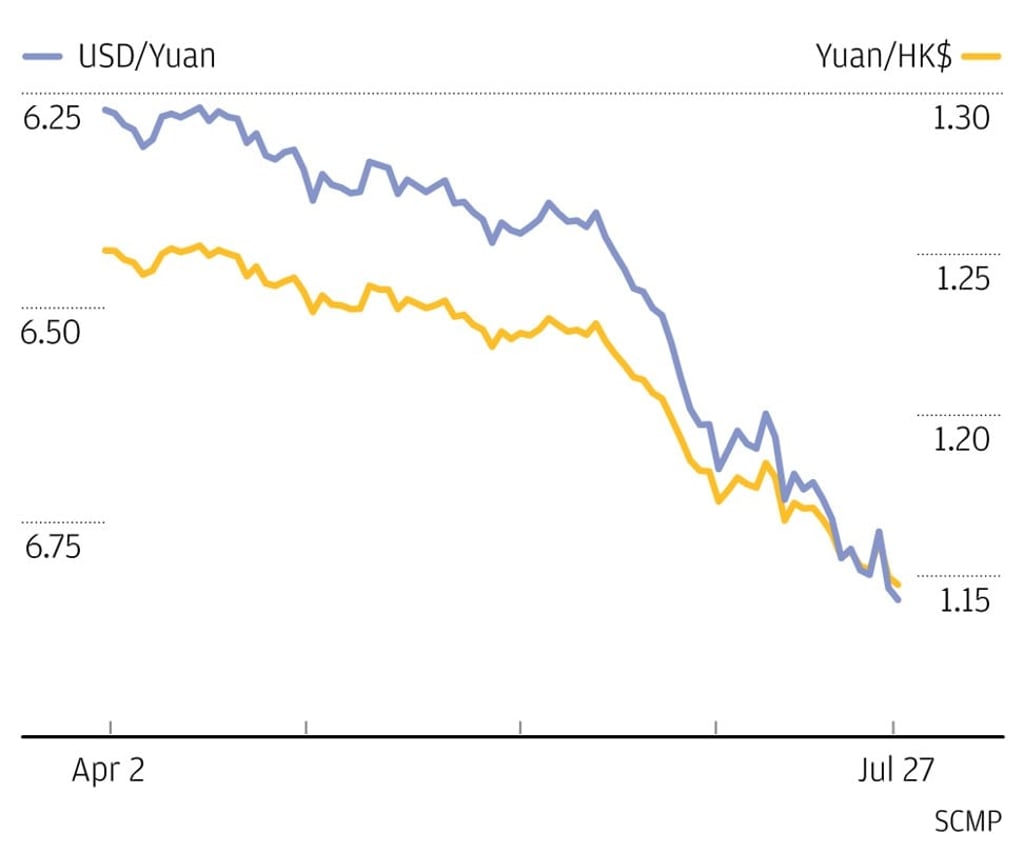

The dramatic sell-off in China’s equity and foreign exchange markets over the past several months has revived memories of the turmoil in the second half of 2015 and early 2016, when the unexpected devaluation of the yuan and a collapse in stocks wreaked havoc on global markets.

The severity of the price declines this year, and the gravity of the external and domestic threats weighing on sentiment towards China, have once again turned the world’s second-largest economy into a focal point of market anxiety.

It is not surprising that investors are having flashbacks of the 2015 crisis. In the space of just 11 weeks, the renminbi has lost more than 7 per cent against the US dollar, compared with 5 per cent during the six-month-long sell-off that followed the surprise devaluation of the currency in August 2015. The Shanghai Composite Index, meanwhile, entered bear market territory last month while Chinese high-yield bonds have suffered the sharpest losses among the leading emerging markets this year.

Advertisement

The renewed nervousness about China’s economy, which stems partly from fears about the impact of a trade war with America, also contributed to a sharp sell-off in the commodity sector, affecting particularly the prices of industrial metals. The Bloomberg Commodity Index, a leading gauge of raw materials prices, has dropped by more than 7 per cent since the end of May.

Advertisement

Advertisement

Select Voice

Select Speed

1.00x