Advertisement

Macroscope | Trade war, Federal Reserve rate hikes should push China to double down on measures to boost growth

David Brown says in the face of global headwinds, China’s policymakers could consider cutting interest rates, slashing taxes and increasing spending to keep the economy on course

Reading Time:3 minutes

Why you can trust SCMP

With US interest rates on the rise, the dollar’s recovery losing steam and global fiscal austerity spreading, China needs a viable policy plan to hit a growth target of around 6.5 per cent amid signs the economy is drifting off course.

Beijing must take corrective steps very soon so that the country has much more cohesive monetary, currency and budgetary policies to avoid being blown off course by headwinds which are dampening global recovery. Complacency is not an option when China’s economy is in desperate need of extra help.

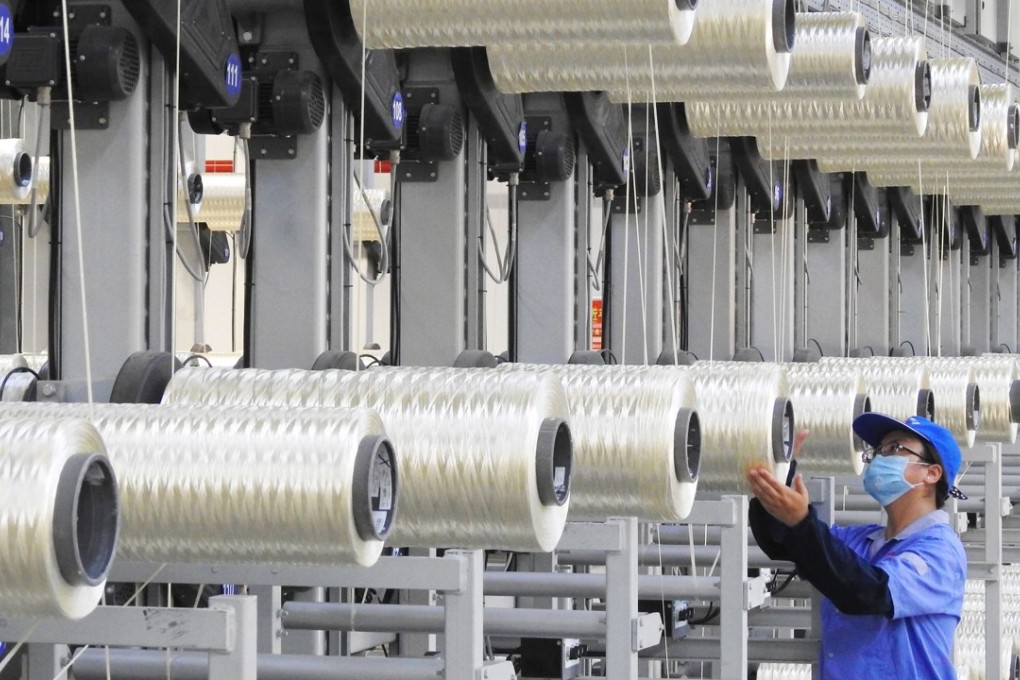

Beijing only needs to study the global landscape to recognise the risks to growth. The most immediate danger is the threat of outright trade war with the US. With China’s manufacturing sector so dependent on smooth-running world trade flows, any serious rupture to global commerce could make a sizeable dent in the country’s growth prospects for years to come.

Advertisement

Storm clouds are already gathering according to recent business surveys showing China’s manufacturing sector under serious pressure from growing trade frictions. September’s Caixin/Markit purchasing managers index (PMI) fell to a 15-month low of 50, the threshold marking the boom-or-bust line for factory activity. China’s official PMI index also fell to a seven-month low of 50.8 in September. China’s manufacturing sector is heading into potential crisis with some factories earmarked for possible shutdown, with significant job losses on the cards.

Watch: Beijing residents hope for swift end to trade war

Advertisement

Advertisement

Select Voice

Select Speed

1.00x