Macroscope | Reign of US equities is here to stay, whatever the market chatter

Nicholas Spiro says momentum of the ‘America first’ surge may have slowed but US stocks remain the best bet for investors, given the persistent strains in Europe and emerging markets

Signs that the period of American leadership in equity markets may be nearing its end have been one of the most talked-about themes in investment research reports over the past several weeks.

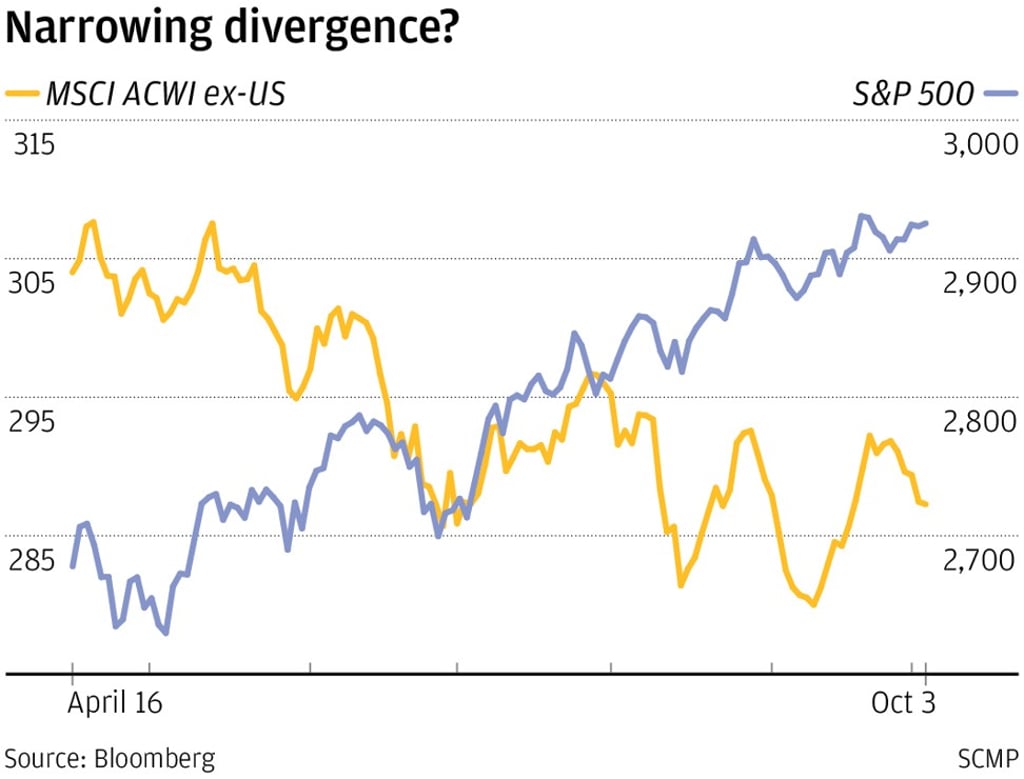

The divergence between US equities and those in the rest of the world has widened sharply this year. Since early May, the benchmark S&P 500 index has surged more than 11 per cent while the MSCI All Country World Index ex-US, a gauge of stocks in advanced and emerging economies which excludes American shares, is down nearly 3 per cent.

The contrast is even starker in the case of the most important equity markets in developed and developing economies. While the Russell 2000, a leading index of small companies that derive their revenues mainly from within the US, is up 8 per cent since early May, the Dax, Germany’s main equity index, and the Shanghai Composite, its Chinese equivalent, are down 4 per cent and 9 per cent respectively.

But over the past month, the divergence has begun to narrow. Not only has the S&P 500 only marginally outperformed the MSCI ACWI ex-US, the gap between America’s benchmark index and emerging market shares has diminished significantly, helped by a 3.7 per cent rise in the Shanghai Composite.