Advertisement

Macroscope | Why the US dollar still reigns supreme and how the renminbi can knock it off its throne

David Brown says there are signs that the US dollar’s dominance as a reserve asset is on the wane but, for the renminbi to fill the gap, China must run a truly independent foreign exchange and monetary policy

3-MIN READ3-MIN

When you are on top of the world, there is only one place to go and that is down. Just how long the US dollar survives as the world’s No 1 currency is a matter of debate. Russia would love to see the dollar knocked off its throne, while Europe and China both believe their currencies can challenge the dollar’s hegemony in the long run.

It will take more than bravado though. A strong economy, a plausible monetary policy and a rock-solid reputation as an ultra-safe money store are vital. The dollar’s currency crown may be slipping but it is not about to fall by the wayside just yet.

Groaning under the weight of tough US sanctions, Russia would love to cut its dependence on the dollar but remains stuck with it. Europe’s hope for vaulting the euro to greater prominence has stalled, while China’s plan to launch the renminbi to greater heights is still in its infancy. By far, the dollar remains the world’s most widely held reserve asset, the most actively traded currency on global foreign exchanges and the main driver for funding world trade. Dollar supremacy seems inviolable for now.

Advertisement

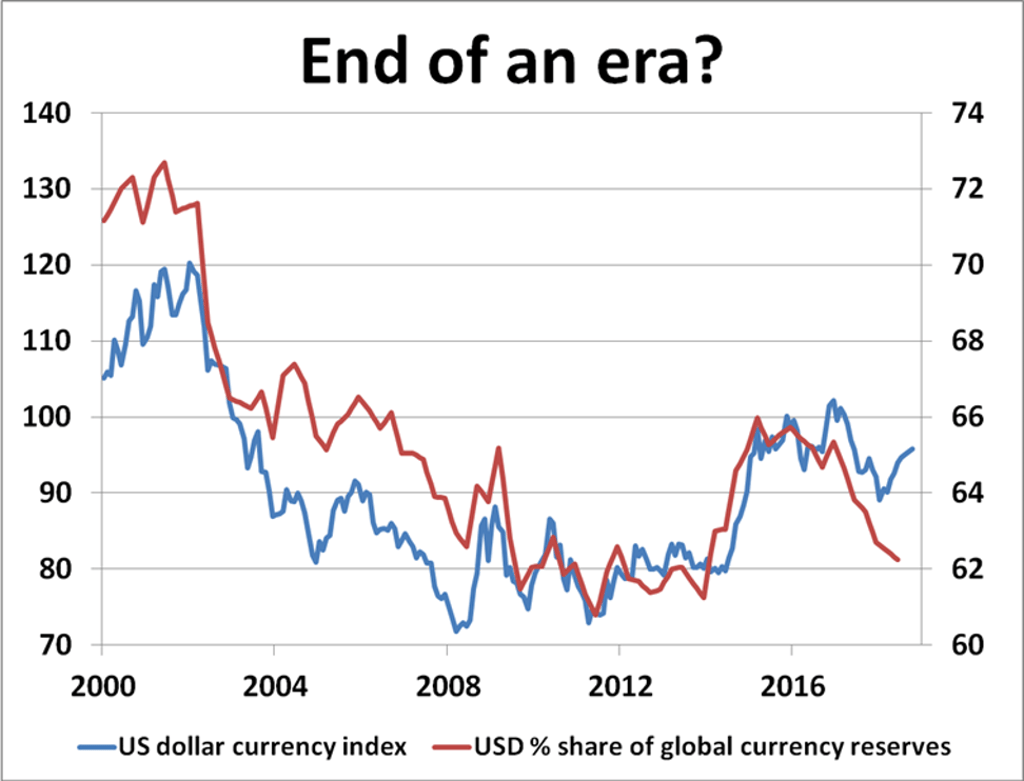

But there are signs of cracks, with the dollar’s share of global central bank reserves slipping from around 73 per cent in 2000 to just over 62 per cent this year, according to the International Monetary Fund’s “currency composition of official foreign exchange reserves” report in June.

The impact of the US Federal Reserve’s extremely loose monetary policy stance after the 2008 crash definitely dampened dollar demand, while President Donald Trump’s economic and political agenda may be causing more headaches for international investors. America’s international standing has taken a heavy knock in recent years.

Advertisement

Advertisement

Select Voice

Select Speed

1.00x