Advertisement

Macroscope | With US data looking ominous, it’s time for a ‘China first’ strategy to brave the economic headwinds

- David Brown says that, on top of China’s slowdown, there are signs of looming trouble for the US, so Beijing needs to turn on the stimulus spigot now

Reading Time:3 minutes

Why you can trust SCMP

It has all been a chimera. Markets are waking up to a bad dream and this is where the nightmare begins. Chaos is taking hold and markets are starting to panic. This is what happens when investors believe in the false prophets of “America first” and the trade truce. US President Donald Trump and much of the artifice of his economic policies and claims are coming undone, global markets are paying the price and China is in harm’s way. It is time to put up the defences and pray for salvation. The world is a mess.

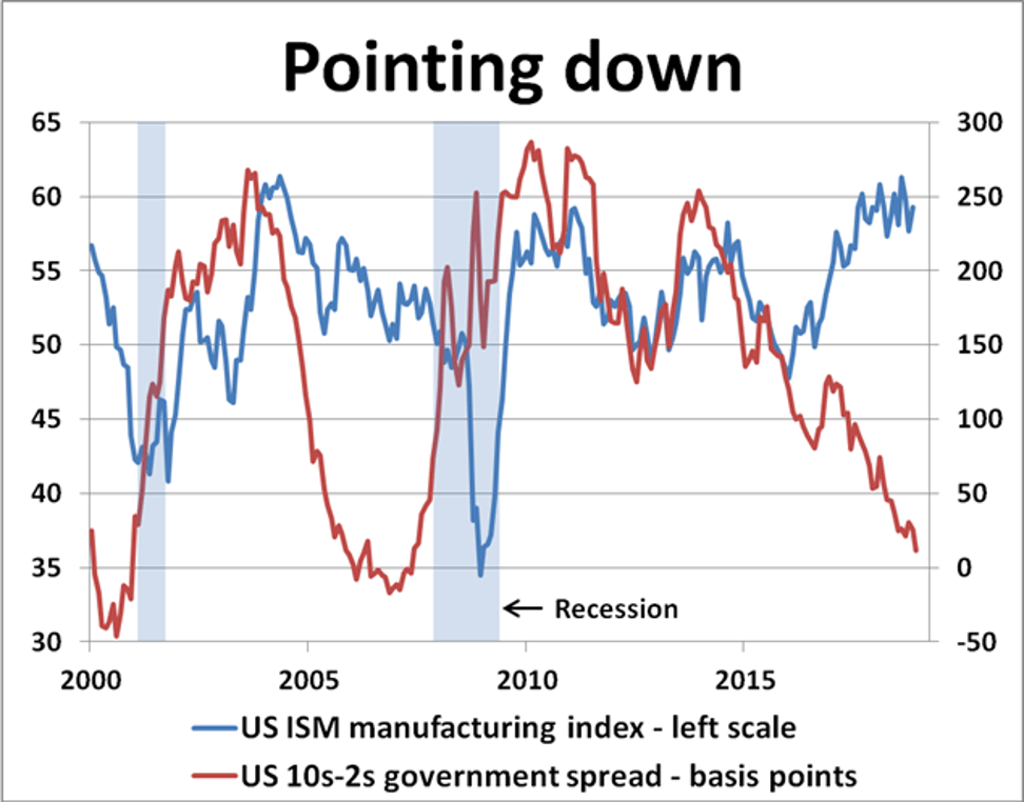

The slowdown is without a doubt coming as global confidence begins to buckle and the US yield curve turns belly up, a much-vaunted market portent of future disaster. In an age where multinationalism is under the cosh and myopic national self-interest is taking over, there is not a lot global policymakers can do to stop the rot. It is every man for himself, China included.

Forget America first, this is where “China first” takes over and Beijing has to crank up domestic recovery. China needs an all-out blitz on monetary, fiscal and economic rejuvenation and Beijing should be channelling all its muscle into stopping a steeper slowdown. Looking at the recent raft of purchasing managers’ index (PMI) data, China’s factory sector is crying out for greater stimulus and in larger size. At least the government now recognises the need for a bigger domestic push.

Advertisement

More technology-led investment and key infrastructure spending is vital. Beijing should dig deep to defend against what happens next. China’s latest National Bureau of Statistics’ PMI measure dropped to 50 in November, right on the well-acknowledged cusp between business expansion and slowdown. With hopes of a quick breakthrough on the US-China trade war fast disappearing, China’s manufacturing sector is looking for much-needed inspiration.

It is unlikely to come from America, judging by the market’s rising fears about US growth hitting a brick wall. Much of last week’s stock market meltdown was sparked by the flattening US Treasury yield curve closing in on negative territory, often perceived by markets as an omen of future recession. The United States’ high-speed economy seems unstoppable on the surface, but the prospect of US yield curve inversion is making markets think twice about a major pile-up lurking ahead.

Advertisement

The two-to-five-year portion of the US Treasury curve has already dipped into negativity with the more carefully watched two-to-10-year spread not far behind. US yield curve inversion reliably foretold of the last two US recessions, in 2000 and 2008, but there is a wide gulf between what the US Treasury curve is hinting right now and the strong level of confidence currently reflected in the US PMI index running close to a 14-year high. Something will eventually give.

Advertisement

Select Voice

Choose your listening speed

Get through articles 2x faster

1.25x

250 WPM

Slow

Average

Fast

1.25x