China’s current three-year economic cycle – measured in nominal GDP growth – is coming to an end, and the question is how hard the landing will be.

The latest economic numbers show few comforting signs. With the manufacturing Purchasing Managers’ Index at its

weakest since February 2016 and industrial profit growth turning negative for the first time in three years, the Chinese economy is confronting formidable headwinds.

The slowdown in economic activity has also exerted pressure on prices, accelerating a decline in both factory-gate and consumer inflation and causing concern that the Producer Price Index might turn negative in the first quarter of 2019. That would create anguish for the industrial sector, reminiscent of the deflationary period from 2012 to 2015.

Domestic woes aside, dark clouds still loom externally. True, the recent news about the trade talks has been

mostly positive, but vice-ministerial meetings concluded without concrete signs that the two sides are reaching a deal.

What is less clear is how much Washington is willing to compromise to avoid an escalation of the trade conflict. A major bone of contention is technology, which includes problems such as

intellectual property theft,

forced technology transfer, and Beijing’s practice of supporting local industries at the expense of foreign competitors.

On issues like protecting intellectual property, Beijing can make tangible concessions, because it is in China’s interests to grow its tech industry and cultivate organic innovation. Effectively, Washington is merely nudging Beijing in the right direction.

In areas such as forced technology transfer, the National People’s Congress is reviewing a new law that will

ban local governments from forcing foreign companies to transfer technology. However, implementation will be key, and Washington is likely to want practical reassurances from Beijing with regard to enforcement. Whether that will be accepted is up for debate, but it is a small gap to bridge.

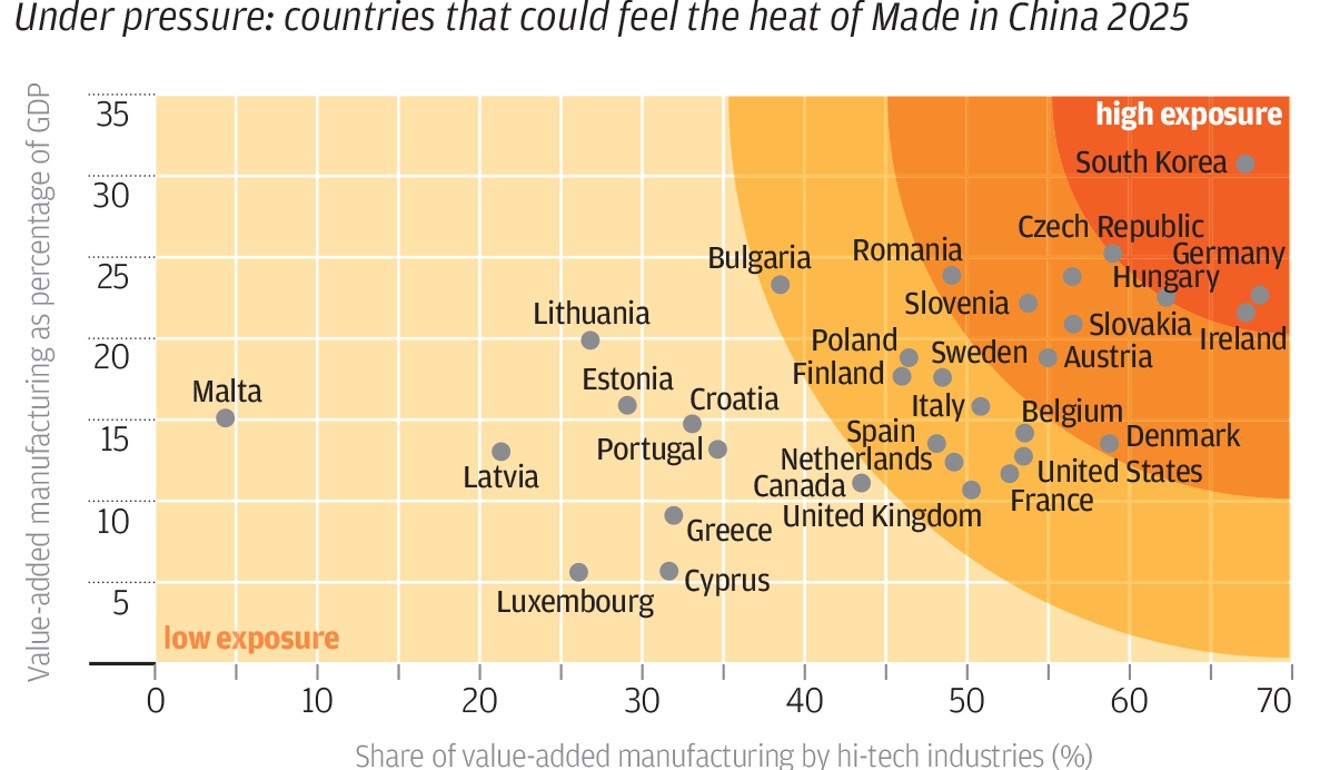

The most contentious issue is China’s industrial policies, which are seen by the US as giving Chinese firms unfair advantages over foreign competition. But, in the eyes of Beijing, it is within its rights to give policy support to emerging industries and to develop the economy; such practices are common among developed, and developing, countries. In fact, the

“Made in China 2025” strategy is widely believed to be inspired by Germany’s

“Industry 4.0” plan.

Since these long-term policies are deemed important for developing China’s hi-tech and advanced manufacturing industries, Beijing may be less willing to offer tangible concessions. This means the White House will have to soften its stance to make a deal possible.

This is at the crux of the negotiations. Given the market gyrations and signs of a slowdown in the US economy, it appears that

Trump is keen to settle the trade war with China. But letting Beijing off the hook without pushing for fundamental changes may not appease the hawkish members of the president’s inner circle. Hence, a resolution is not yet a done deal, and investors should keep their guard up in the coming weeks.

All in all, the fundamental conditions in the Chinese economy will probably get worse before they get better.

While monetary and fiscal policies have limitations, constrained by the still-tight financial regulations or the

size of the budget deficit, the collective easing suggests that the authorities are committed to fighting an economic downdraft.

Notably, the closed-door

Central Economic Work Conference late last year emphasised the importance of six “stabilities”, starting with employment. The policy-easing measures are expected to stabilise economic growth at around 6.1 per cent in the second half of the year.

For the economy, 2019 is set to be more challenging than 2018. But, for the market, since a lot of negative fundamental news has already been priced in, the proactive policy management and the prospective end of the trade war may offer some scope for a rebound. Instead of running scared from deteriorating fundamentals, investors should take a nimble approach to investing in China.

Aidan Yao is senior emerging Asia economist at AXA Investment Managers

This article appeared in the South China Morning Post print edition as: Amid economic slowdown, window is open for investors