Advertisement

Macroscope | How China’s yuan can gain ground against the US dollar and the euro as a global reserve currency of choice

- David Brown says the yuan has a gap to fill as the dollar’s share as a reserve currency slips and concerns about the euro’s future persist. However, market liberalisation and a hands-off approach to the currency in China are crucial

Reading Time:3 minutes

Why you can trust SCMP

Everyone wants to knock the US dollar off its throne as the world’s leading currency. Europe has tried and failed, with the euro’s hope for global forex glory badly dented by the European debt crisis. Beijing would love to see the yuan leapfrog into pole position but it is losing the hearts and minds campaign to win over markets and build confidence in the yuan as a credible dollar alternative. Beijing has its work cut out if it is going to steal the dollar’s crown before the 21st century is out.

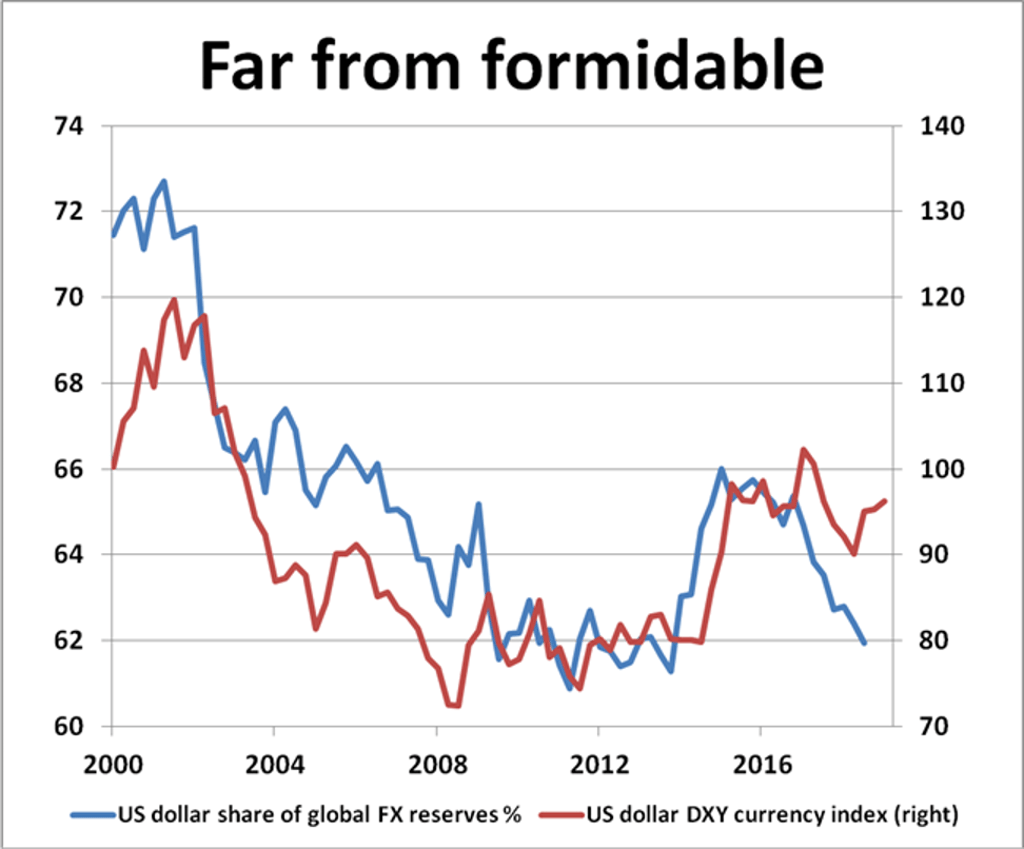

Just because China’s yuan now officially ranks as a reserve asset currency with global central banks hardly means a jot. The yuan has come from a standing start in 2016, when it was first granted reserve asset status by the International Monetary Fund, but its progress to date has been less than stellar. By the end of the third quarter last year, foreign exchange reserves denominated in renminbi only accounted for a meagre 1.8 per cent of the world’s US$11.4 trillion outstanding reserves. That compares with 62 per cent held in US dollars and 21 per cent based in euros according to the IMF’s currency composition of official foreign exchange reserves report – not too far behind the Japanese yen’s 5 per cent ranking.

China still has a lot of catching up to do to win greater international recognition and credibility for its yuan-based financial asset markets. In reality, the yuan still only has minor novelty value as a holding currency with central banks and the same can be said for its domestic government bonds, which are only slowly gaining acceptance on global bond indices. The yuan is still a long way off being seen as a gilt-edged investment, a top-notch reserve asset or a universally accepted means of exchange like the US dollar.

Advertisement

Unless Beijing makes greater strides to close the credibility gap, yuan-based investments will forever remain marginal markets for most international investors. Beijing needs to change perceptions so that these investments are seen as much more than risk assets to be dumped by investors at the first sign of market stress. Beijing needs to build full confidence in domestic markets with good depth and breadth and ample liquidity, backed by sound policy principles.

Advertisement

China must free up its markets to all investors. It needs a radical action plan for market liberalisation, fast-tracking financial deregulation, speeding up reforms and heading towards full exchange rate convertibility. The yuan must be seen as more than just a “puppet currency” at the beck and call of government policy. Beijing must adopt a laissez-faire attitude towards currency intervention, with a hands-off approach to market manipulation, apart from the necessary official smoothing operations when financial stability is under threat.

Advertisement

Select Voice

Select Speed

1.00x