Macroscope | Good news for investors: Donald Trump needs a China trade deal as badly as they do

- Confusion reigns in global markets, as world growth and even US manufacturing slow. But the US president’s eagerness to achieve a breakthrough with China should not be underestimated, even as dark clouds surround his presidency at home

However, although there are some signs that more conservative-minded global fund managers are scaling back, it’s far from a capitulation. According to Reuters’ latest asset allocation poll, as a safety hedge, global asset managers raised cash reserves from 6.2 per cent in January to 7.2 per cent in February, the highest since 2015. They also cut equity exposures to 45.9 per cent, the lowest in two years, citing worries about the US-China trade row and its impact on global growth. It is a modest adjustment so far, which suggests investors are keeping their options open.

Central banks need to take stock. Policymakers not only have a duty of care to set the best parameters for non-inflationary growth and job creation in the future, but also a moral obligation to create the right setting for risk-taking, financial stability and investor confidence. With the global economy still feeling the deflationary aftershocks of the 2008 crisis, the last thing consumer confidence needs is any more financial market turmoil or further blows to wealth perceptions. Central banks need to be ahead of the curve and stay proactive.

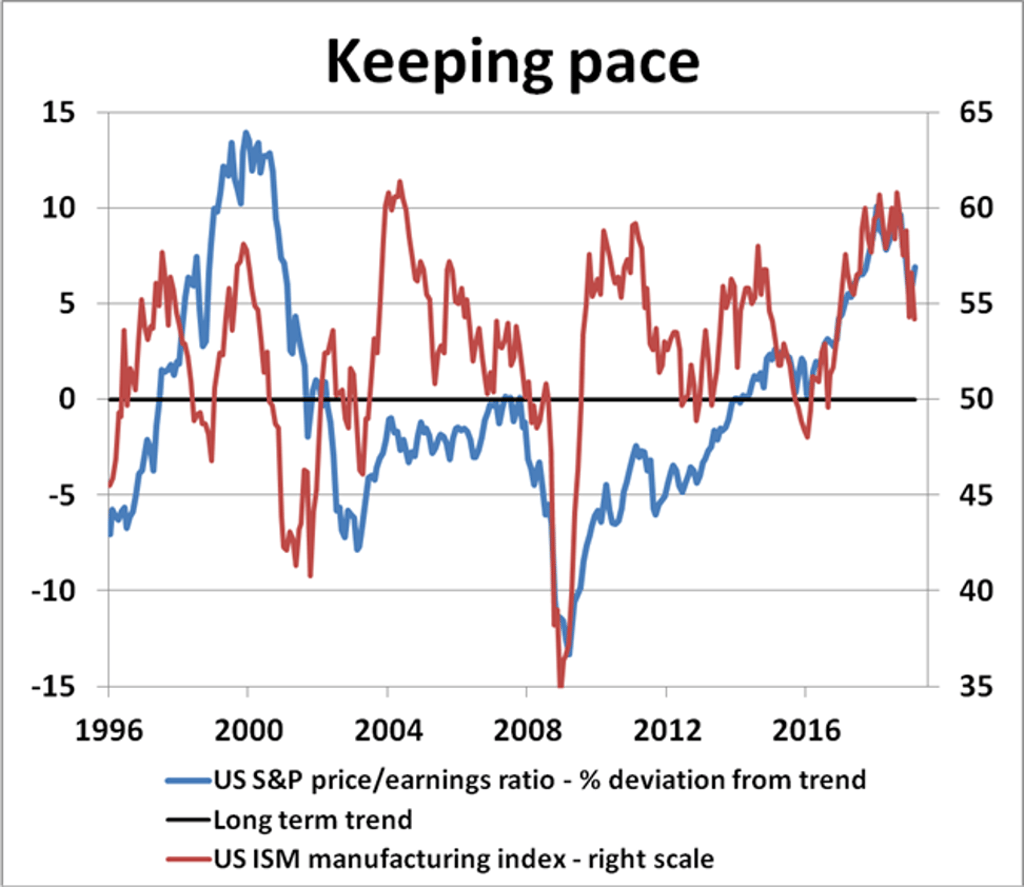

Investors are desperate for clearer clues from the real economy. In the US, benchmark indicators like the Institute for Supply Management (ISM) manufacturing index are already testing investor perceptions of the fair value of shares, especially as the ISM heads towards the boom-or-bust threshold of 50 per cent. Although recent US employment reports have been solid as a rock and provided considerable support for stock market confidence over the past, nothing is guaranteed to last. The February US non-farm payrolls report, expected on Friday, is not only a critical test for market stamina but also a potential challenge to the Fed to fine-tune its policy.