Advertisement

Macroscope | Not just China: why the global economy needs Beijing’s stimulus measures to boost growth

- David Brown says concerns are growing around the world about slowing growth, and only Beijing – not Britain, Japan, the EU or even the US – are in a position to revive economic hope

Reading Time:3 minutes

Why you can trust SCMP

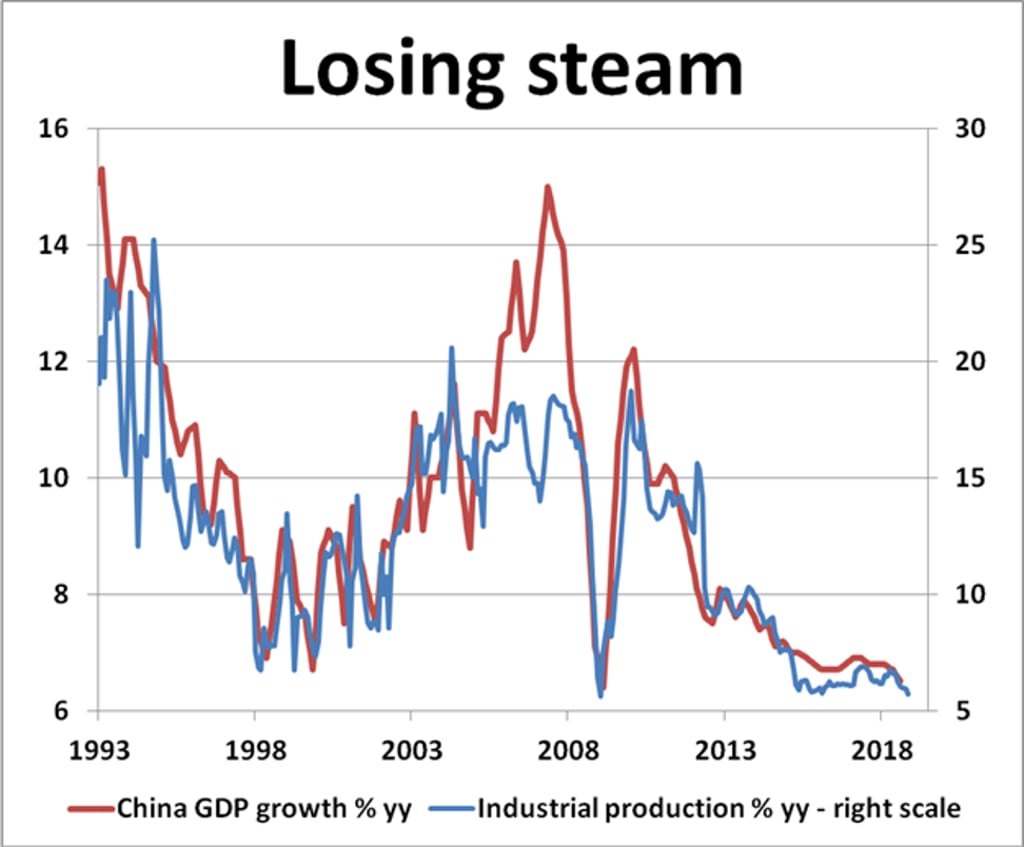

For global economy watchers and forecasters, China’s growth prospects could be make-or-break for world markets in 2019. With some pessimists starting to wonder whether financial markets are already heading for a rerun of the 2008 crash , just how well China withstands the global downturn could be the key for confidence. The worry is that China’s descending growth rate over the past few years could easily nosedive into a heavy, hard landing unless sweeping changes are made to the government’s policy initiatives. Beijing must get moving soon to turn the tide.

Unless Beijing acknowledges the scale of the impending crisis, China’s economy could end up badly behind the curve. It is all very well talking up the economy with upbeat growth forecasts, but being long on hype and short on reality is taking a gamble. It is time to be much more frank about the risks to global growth and how much more Beijing needs to do to pull China’s economy up by the boot-straps and to help fast-track quicker recovery.

Until China’s planners come up with hard forecast numbers, markets can only guess at what officials are pencilling in for 2019. Recent hints suggest targeted growth for gross domestic product might be scaled back to between 6 and 6.5 per cent from a likely outturn of 6.5 per cent this year. Given the downward drift in recent years, China is clearly struggling to match the glory years of double-digit growth in the not-too-distant past.

Advertisement

Despite the prevailing headwinds, market forecasters seem relatively unfazed right now, with expectations for China’s growth rate next year ranging between 6 and 7 per cent, with an implied average of 6.3 per cent, according to the latest Reuters’ market survey. It suggests too much complacency is building, leaving global markets more susceptible to downside surprise risks. Equity and credit markets could be seriously exposed as growth expectations are downgraded.

Advertisement

The global economy faces a formidable uphill struggle in 2019. US growth prospects may well pull up short thanks to relentless Federal Reserve tightening, Japan’s economy is struggling, Europe looks more vulnerable and Britain could fall into a Brexit black hole. Emerging markets risk being dragged under as the crisis spreads. The world economy is stalling and in dire need of a jump-start. The trouble is that all available global policy stimulus is currently running close to empty.

Advertisement

Select Voice

Select Speed

1.00x