Advertisement

How China’s Belt and Road Initiative can get a green push from the Asian Infrastructure Development Bank

Reading Time:2 minutes

Why you can trust SCMP

When the Asian Infrastructure Investment Bank (AIIB) was founded just over two years ago in Beijing, many in the international community were concerned that the China-led multilateral bank would run roughshod over existing international standards in development finance. For now, the worst fears have not materialised.

The bank has an environmental and social framework, a grievance mechanism, an energy strategy, and has engaged civil society to a certain degree. It has also avoided directly funding any coal, oil and mining projects.

These are positive steps. But the bank now needs to anchor this in policy. It could lead the field in green multilateral infrastructure investment if it took steps to commit to a 100 per cent renewable energy portfolio.

Advertisement

The bank should also ensure its investments in financial intermediary funds subscribe to a strict coal- and oil-free finance policy, to make sure the bank does not finance these projects indirectly, as has been a concern to date. This will send a strong signal of the bank’s long term commitment to sustainability and make the AIIB a “green” leader among multilateral development banks.

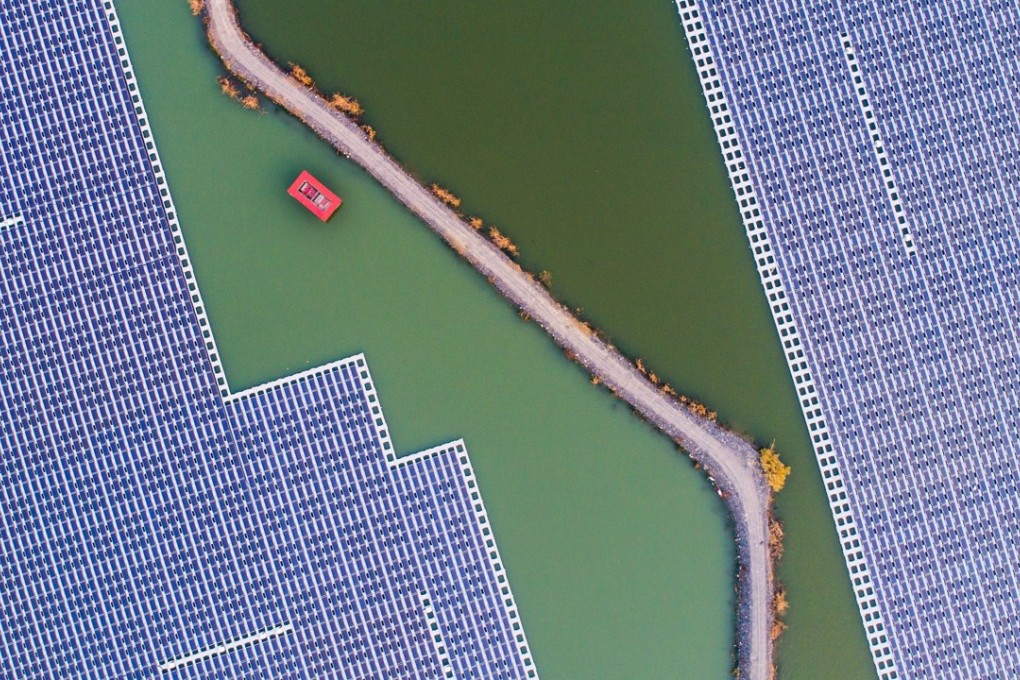

Bold steps towards a 100 per cent renewables policy would send a strong signal that China intends to “green” its Belt and Road Initiative. As the most ambitious geo-economic project in recent history, spanning some 70 countries and over US$1 trillion in investments, it’s imperative that institutions ensure high environmental, social, and governance standards in its implementation.

AIIB must keep its pledge of being ‘lean, clean and green’

Advertisement

Select Voice

Choose your listening speed

Get through articles 2x faster

1.25x

250 WPM

Slow

Average

Fast

1.25x