Advertisement

Letters | For virtual banking to thrive in Hong Kong, regulators must encourage small players and innovation

- The Hong Kong Monetary Authority should consider relaxing capital requirements for virtual banks, as the UK has done, and must set clear expectations for creative financial services

Reading Time:2 minutes

Why you can trust SCMP

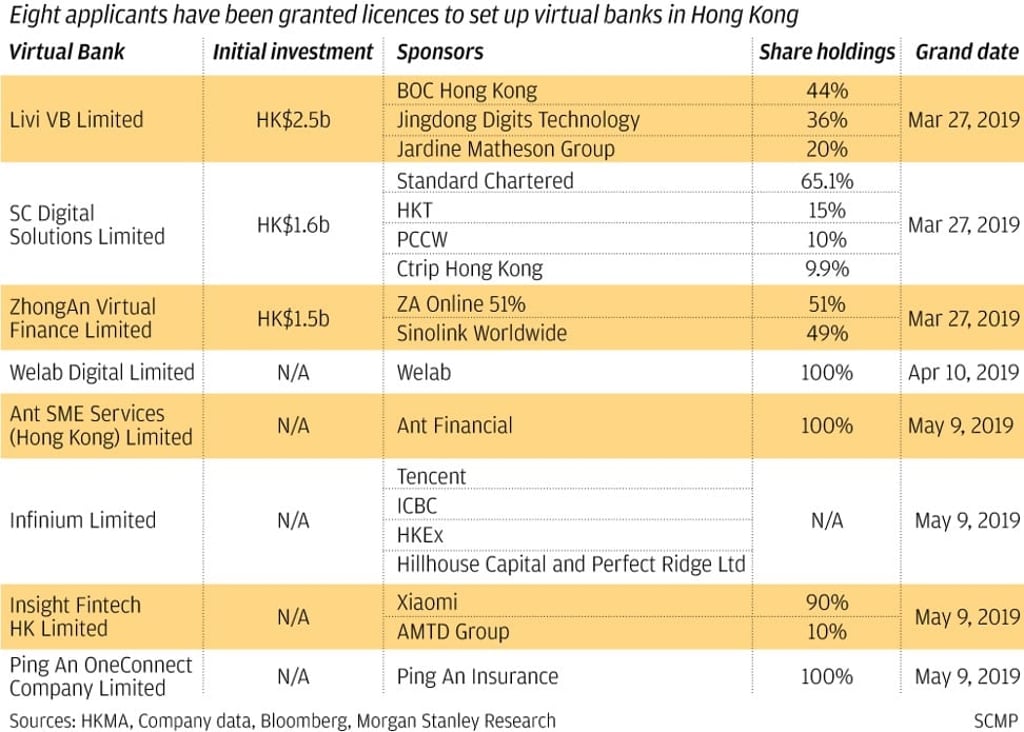

To promote financial innovation and inclusion, the Hong Kong Monetary Authority (HKMA) issued guidelines on the authorisation of virtual banks in February 2018 and has since granted virtual bank licences to eight applicants. While the moves could provide momentum for the city’s financial industry, the HKMA should consider relaxing the capital requirements for virtual bank licensees and setting clear expectations for creative financial services in order for society to benefit from virtual banking.

To ensure a level playing field for all aspiring virtual banks, the HKMA should reduce the minimum capital requirement currently set at HK$300 million (US$38.3 million), the same amount expected from the traditional bank licensees.

Given such a stringent requirement, those supported by large corporations are more likely to apply, with more financial capital at their disposal and less pressure to make profits in the short term. This seems to be the case with most of the licensees so far, as they are backed by heavyweight investors such as Alibaba, Tencent, Xiaomi, Ping An and Bank of China.

Advertisement

To encourage more start-ups to offer virtual banking services, HKMA should follow the international practice of expecting less capital than traditional banks. The United Kingdom, for example, set the capital requirement for its virtual bank licensees at US$5.8 million but requires them to develop exit plans to cease operations without harming customers in case of business model failures. As the HKMA also imposes a similar exit plan requirement, it makes sense for the authority to reduce the minimum capital requirement.

Advertisement

The HKMA should also communicate its expectations of fintech innovation to the virtual bank licence holders and applicants more clearly. While the virtual banks will serve their customers without bricks-and-mortar offices and with no minimum fees to exclude the less affluent, HKMA has made no explicit requirements regarding banking service innovation.

Advertisement

Select Voice

Choose your listening speed

Get through articles 2x faster

1.25x

250 WPM

Slow

Average

Fast

1.25x