Letters | Why modern monetary theory – or printing money at will – makes for a bleak future

Once upon a time, most people were employed in agriculture, and economic activity was relatively subdued. Then came the Industrial Revolution and agriculture began to shrink as the population moved into cities and started turning raw materials into products at an ever increasing pace.

More money was required to enable commerce to expand and one by one countries abandoned the gold standard as a backing for currency. Greater economic activity required governments to increase money supply to facilitate commerce. Hence Keynesian policies became de rigueur.

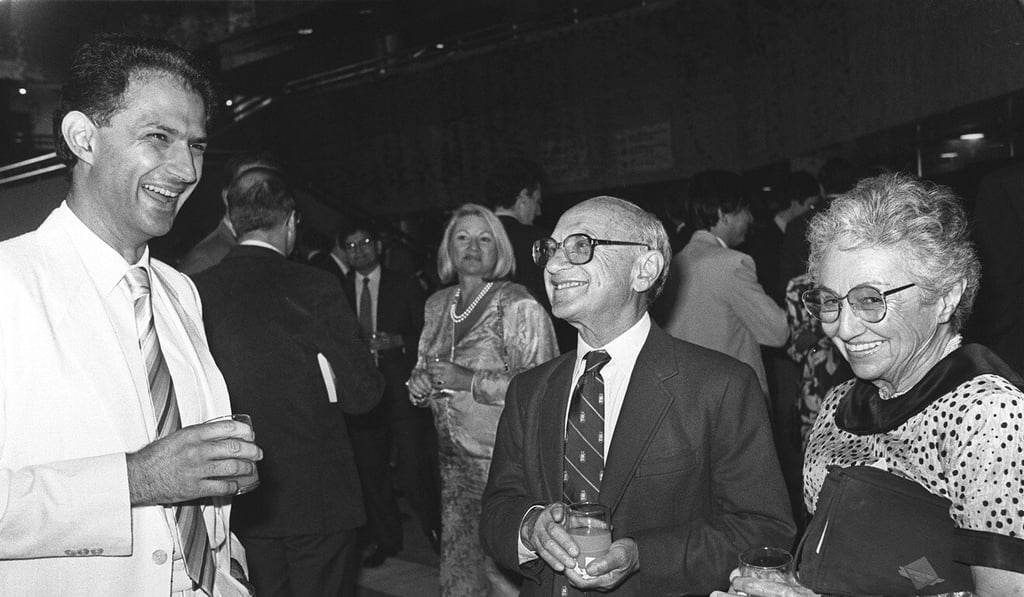

Unfortunately in the 70s the steep increase in oil prices caused stagflation. We saw the rise of Milton Friedman and supply-side economics, popularised by US president Ronald Reagan and British prime minister Margaret Thatcher. Taxes were cut and unions smashed, causing the wealthy to become wealthier and budgets to explode.

Basically, central banks can just keep printing money to maintain economic activity. This theory works wonders for the asset classes owned by the well-heeled. Inflation remains stubbornly low, despite all the money central banks print.