Advertisement

Letters | Hong Kong economy: to ease budget deficits, stop subsidising large companies

- The financial secretary must review funding programmes such as those subsidising industrial estate land, which is then used by large companies such as data centres

Reading Time:2 minutes

Why you can trust SCMP

Because of its currency peg to the US dollar, Hong Kong does not have an independent monetary policy, which also means that we cannot sustain the current budget deficit in the long run. Article 107 of the Basic Law also stipulates the adherence to “fiscal balance” as a norm.

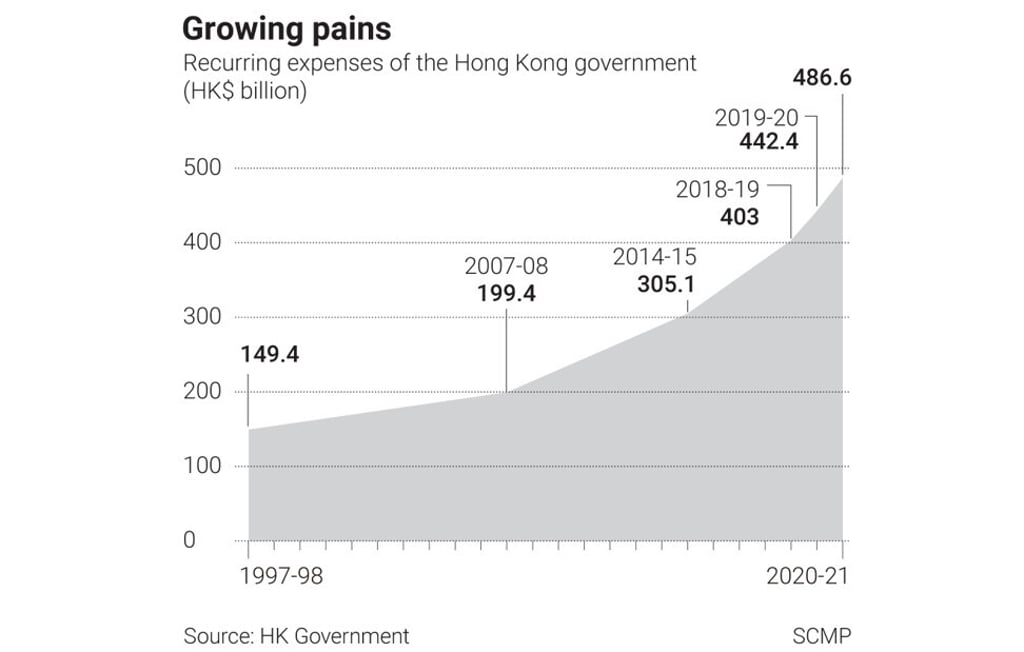

Last year, the Hong Kong government spent over HK$300 billion on Covid-19 relief measures. Financial Secretary Paul Chan Mo-po has predicted that Hong Kong will be in the red for the next few years. Recurrent expenditure is growing at an accelerating pace. It will only be a matter of time before Hong Kong runs a structural deficit.

Short-termism is a disease that feeds on others peoples’ money. As there is an overwhelming cry for instant help, our society has overlooked the need for long-term sustainable growth. And there is a difference between squandering reserves and directing resources to generate growth.

Advertisement

Mr Chan, I humbly ask you to review the current funding programmes to end any rent-seeking behaviour in Hong Kong. These corporate welfare programmes only bring minimal, if any, long-term economic benefits. A glaring example is opportunists taking advantage of taxpayers in industrial estates.

Advertisement

According to media reports, a cryptocurrency firm recently held promotional events at ATV’s premises at the Tai Po Industrial Estate, and seems to be based there.

Advertisement

Select Voice

Choose your listening speed

Get through articles 2x faster

1.25x

250 WPM

Slow

Average

Fast

1.25x