It’s not getting any easier for China’s growth plans this year with storm clouds on the international front and potential

economic squalls brewing at home. Hitting its 6-6.5 per cent

GDP target for this year would be a tough ask under normal circumstances. But with a deepening US

trade war posing a greater threat to domestic well-being, Beijing needs to pull out all the stops to build much stronger defences around the economy in the coming months.

It’s not just slower world trade flows harming China’s export sector; there are growing risks that the downturn in global confidence will spill over into weaker consumer spending, hitting business activity even harder. Beijing also needs to ensure orderly operations in the financial system to avoid the risk of a nasty credit squeeze. The recent rescue of

Baoshang Bank highlights that Beijing must keep China’s markets flush with funds to ensure stable monetary conditions.

Hitting this year’s growth target is still achievable but it means policymaking must go the extra mile. More wide-ranging easing is needed, with additional tax cuts, extra fiscal spending, more monetary boosts, easier credit conditions and a more relaxed currency stance to bolster growth. Headwinds are getting stronger and Beijing must move fast to buck the trend.

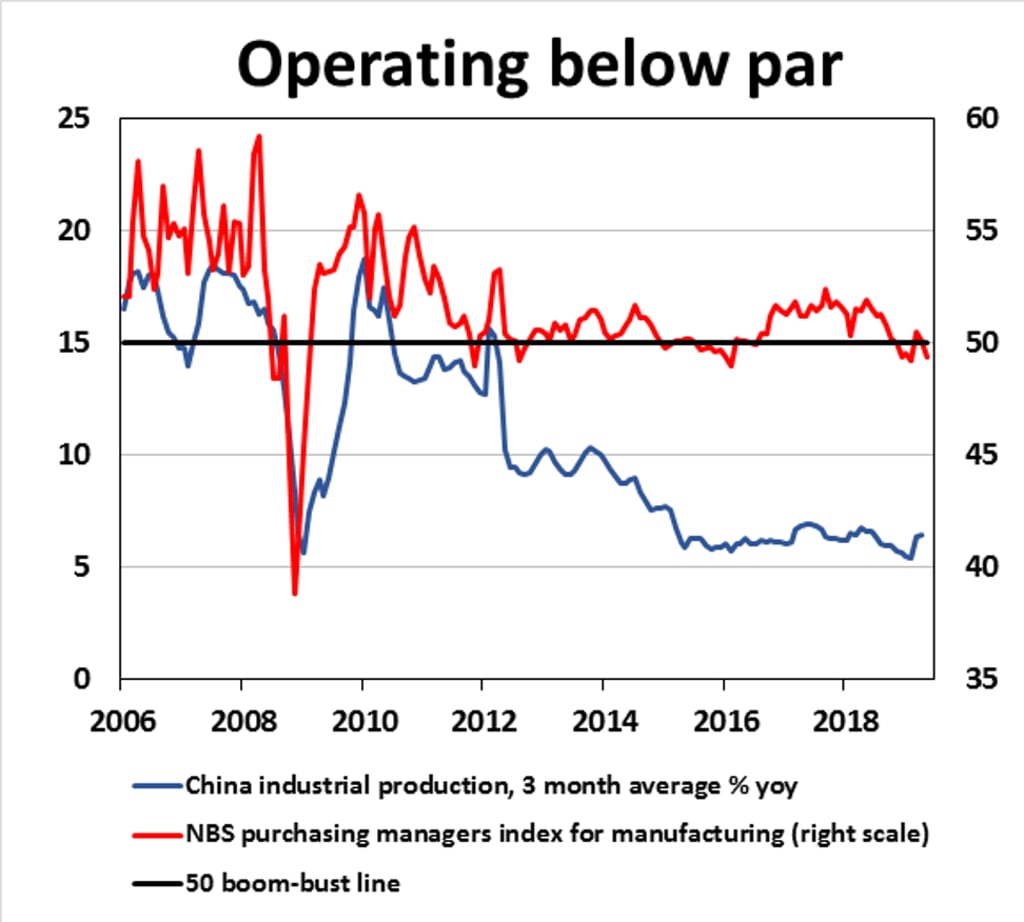

Even though the three-month rolling average for Chinese industrial production growth picked up moderately in April, to 6.4 per cent year on year, business confidence is still showing signs of wear and tear. Last month, the NBS purchasing managers’ index for manufacturing dipped below the 50 boom-bust threshold for the second time this year, a harbinger of weaker growth trends ahead.

Top of the agenda, Beijing needs to find a quick resolution to the trade war with Washington. It’s not a question of yielding to US demands; both sides must reach a quick compromise to rescue the outlook for world trade and global economic confidence. According to data from the CPB Netherlands Bureau for Economic Policy Analysis, world

export growth has slowed to a virtual standstill. This must be addressed as soon as possible.

If the slowdown persists, International Monetary Fund forecasts for 3.3 per cent global growth

this year, the weakest rate since 2009, could be at serious risk. It’s no wonder world equity markets are rattled. It would be to Beijing’s advantage to show strong leadership in defusing trade war tensions, especially at a moment when Washington appears to be riding roughshod over its

trading relationships elsewhere.