Advertisement

Has Asia’s commercial property bull market peaked? Here are three reasons to suggest it has further to run

- Investors are still ploughing money into the Hong Kong office market, for example, even though prime yields are close to three-month US bond yields. Clearly, there’s a lot more money waiting to be deployed across the region

Reading Time:3 minutes

Why you can trust SCMP

One of the attractions of investing in real estate is that the returns on offer are invariably higher than those on benchmark government bonds.

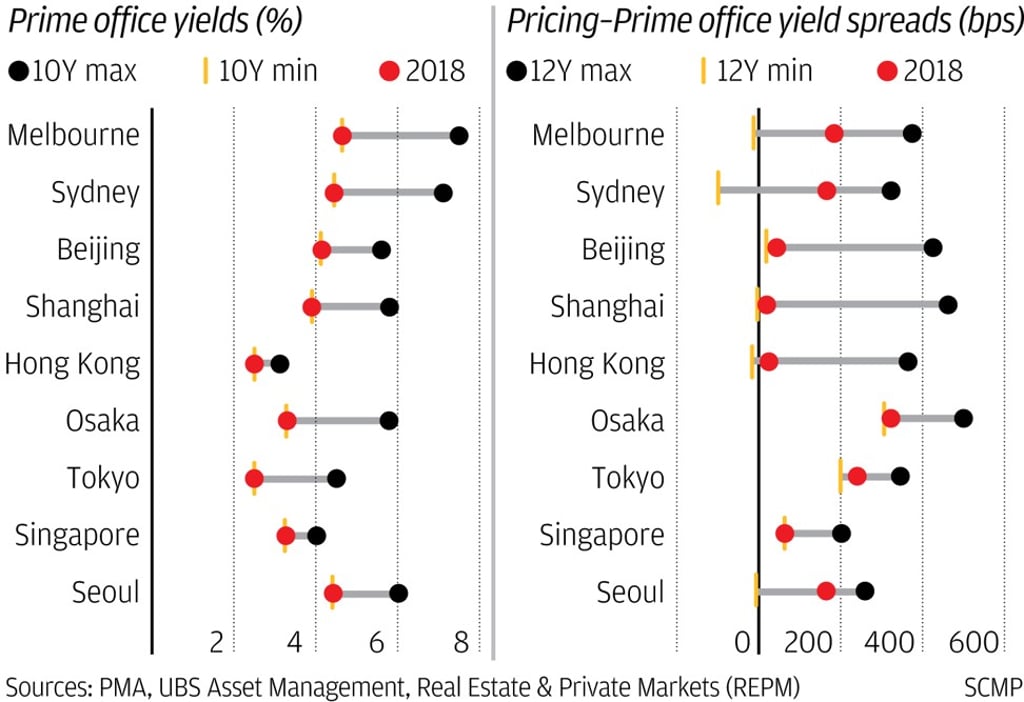

Yet, over the past decade or so, the spread, or gap, between rental yields and their fixed-income equivalents has narrowed sharply as property yields have shrunk, driving up prices. In the commercial real estate market, the average prime yield across 50 major cities tracked by property adviser CBRE has fallen from about 7 per cent in 2009 to just over 4 per cent at the end of 2018.

While this may seem like a steep decline, bond yields have also dropped precipitously – and are even negative in the case of Japan and Germany – which has allowed commercial real estate to maintain its advantage over bonds.

Advertisement

However, in some of Asia’s property markets, spreads are barely in positive territory. In Hong Kong, prime office yields currently stand at just above 2 per cent, one of the lowest levels among the world’s most actively traded office markets. This not only leaves the city with one of the thinnest office yield spreads globally – Hong Kong’s 10-year bond yield is just below 1.6 per cent – the rental yield is now more or less on a par with the yield on three-month US Treasury bills, which stands at 2.35 per cent.

This begs the question: if even ultra-safe, cash-like three-month Treasury bills offer a similar return to a Grade A office building in Hong Kong – where leasing demand, particularly from mainland companies, in core districts has weakened significantly and rents are forecast to decline this year – how can investors justify ploughing money into illiquid and much riskier assets in an office market that is already the world’s priciest and is considered by many to have reached its cyclical peak?

Advertisement

Advertisement

Select Voice

Select Speed

1.00x