Advertisement

US Fed set to lead the way on lower interest rates, and China can benefit from another cut

- As global economic conditions grow more worrisome, China should lower interest rates and ramp up spending in key areas such as health, welfare and pensions, thus motivating citizens to save less and get the consumer-driven economy moving

Reading Time:3 minutes

Why you can trust SCMP

The whispering campaign has already begun that US monetary policy should be tilting towards lower interest rates very soon. Once the Federal Reserve moves, other central banks should follow suit and China won’t be too far behind. Global trade tensions have exacted a heavy toll on the world economy and policymakers need to lay down some positive ground support before it’s too late. The world is staring into the jaws of another crisis and crying out for a new wave of easing.

If St Louis Fed president James Bullard has recently been a stalking horse for lower rates, his message couldn’t be clearer. The fallout between the US and China has been catastrophic for growth prospects and, with Washington raising trade tensions to new levels with Europe, Mexico and India, the outlook is deteriorating fast. The risks to growth are rising, headline inflation pressures look spent and lower rates may be warranted soon, according to Bullard.

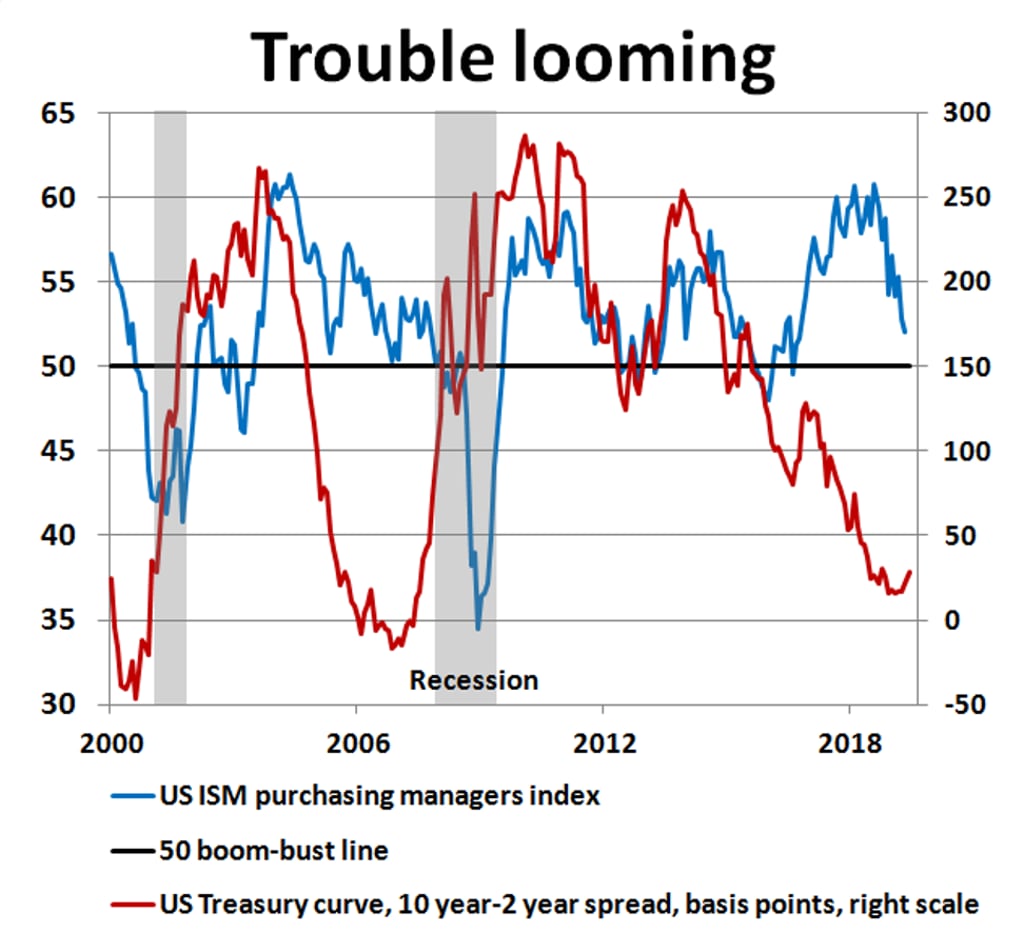

Forward-leading indicators have been pointing this way for quite some time with protracted weakening in US business conditions and some dramatic flattening in the US Treasury yield curve acting as early warnings to trouble ahead. Bullard might be in the minority right now but the longer the Fed delays easing, the greater the threat to the economy longer term.

Advertisement

Markets are skating on thin ice and another collapse in confidence so soon after the 2008 crash could have grave consequences. The Fed and the major central banks have a duty of care to prevent it happening.

China has nothing to fear from another rate cut. Indeed it could give Beijing a better chance of hitting its 6-6.5 per cent growth target this year. China needs to muster all its resources to keep the economy working at full strength against the negative tide. This means easier monetary conditions to keep domestic demand strong, combined with some moderate currency relaxation to help the export sector weather the storm.

Advertisement

China’s interest rates probably need to come down by another 1 percentage point, at least, to ward off downside risks to growth. Beijing may be reluctant to cut rates on its own but an early rate cut from the Fed could provide the right incentive to ease again and spur consumer confidence and household spending. With consumer demand accounting for up to two-thirds of economic growth nowadays, it could breathe much-needed life into the recovery.

Advertisement

Select Voice

Select Speed

1.00x