Advertisement

As global growth slows, the world needs a new Marshall Plan, not lower interest rates

- Central banks cutting rates will only feed the addiction to cheap money. Instead, the US, Europe and Japan must contribute more to global efforts, like infrastructure-spending plans, to reboot recovery and worldwide trade

Reading Time:3 minutes

Why you can trust SCMP

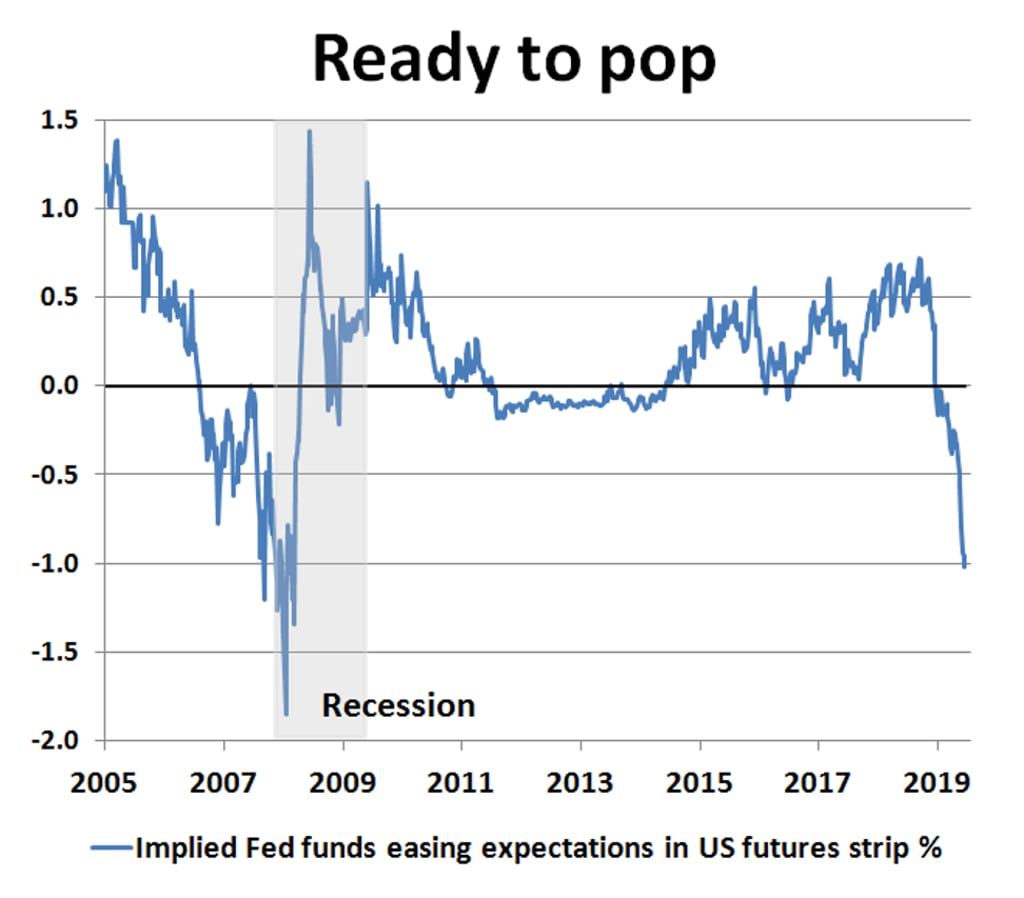

The world is heading back into the labyrinth of lower interest rates. The US Federal Reserve’s patience has finally run out and the global economy is lurching towards a new reckoning on rates, possibly as early as July’s Federal Open Market Committee meeting. Despite a near-record US economic expansion, the Fed sees something on the horizon it doesn’t like.

The US-China trade war is taking its toll, global economic confidence is stalling and regional problems abound. It’s time for the Fed to lead the way to lower global rates. The key question is whether the world really needs it and if there is a better alternative.

The world has become addicted to cheap money and debt. In recent years, the Fed has done its best to lead the world back towards monetary “normality”, targeting US interest rates towards the 3 to 4 per cent neutral zone but giving up because the world still seems stuck in a post-crash torpor.

Advertisement

The trade war has not helped, nor have mounting military tensions between the US and Iran. Central banks cutting rates again to keep the global economy and world financial markets on a positive footing may help for a while but it seems more akin to throwing good money after bad.

Advertisement

The world needs a fresh start and better perspectives in the post-crash era. Policymakers did a great job of clearing up after the 2008 global financial crisis but it is still a work in progress.

Advertisement

Select Voice

Choose your listening speed

Get through articles 2x faster

1.25x

250 WPM

Slow

Average

Fast

1.25x