Advertisement

Wealthy financial markets must start to pay their way to help the poor, and a global ‘Robin Hood’ tax is the way to do so

- When financial markets crashed in 2008, central banks were quick to slash interest rates and print money. The subsequent financial boom was basically subsidised by taxpayers – now it’s time for financial markets to return the favour

Reading Time:3 minutes

Why you can trust SCMP

The world is crying out for a radical rethink on better ways to bolster global growth, redress income and wealth imbalances and improve the future for all mankind. The major industrial countries have enjoyed a disproportionate share of global economic success for far too long, with less-privileged economies falling further behind the curve.

The need for sweeping change is long overdue and a global financial transactions tax, or FTT, may be one way to redress the balance. It is time for wealthy financial markets to step up and do their bit to foster faster global growth and pay their way to a fairer world.

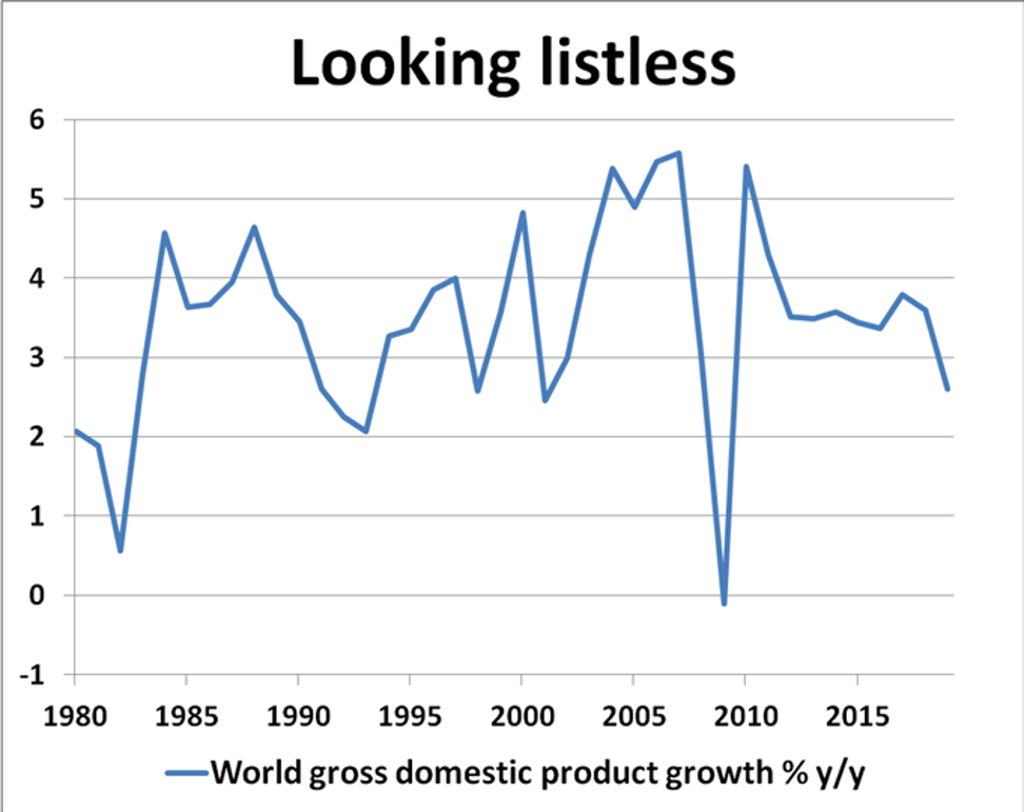

The world’s economic growth potential has been slipping badly in the past few years and is in urgent need of shoring up. The World Bank reckons global growth could be as low as 2.6 per cent this year, well down from a rate in excess of 5 per cent as recently as 2010.

Advertisement

This is hardly enough to keep the developed world ticking in terms of decent job creation and financial stability, let alone keep living standards, health and education opportunities improving in poorer nations. The world has to find a better way to channel resources from prosperous top-tier nations to less well-off economies desperate for new investment and development capital.

Advertisement

When financial markets crashed in 2008 and the global banking system came close to collapse, governments and central banks were quick to slash interest rates and print more than enough money to batten down the hatches. The subsequent monetary jamboree provided the cornerstone of a global financial boom, subsidised by taxpayers, households and savers through higher taxes, tougher austerity measures and lower savings rates. Now it’s time for financial markets to return the favour.

A universal FTT could be the centrepiece. The FTT, or “Tobin tax”, was first envisioned by economist James Tobin after the breakdown of the Bretton Woods fixed exchange rate regime in 1972: the proposed levy on currency transactions would be a way to stabilise global currency markets and discourage excessive speculation. In today’s post-crash era, a global FTT could be an effective deterrent to high-frequency trading and unnecessary risk-taking in financial markets.

Advertisement

Select Voice

Select Speed

1.00x