Macroscope | Economic slowdown’s spread to Asia highlights the need for global policy coordination

- The sluggishness of the global economy shows the need for broad policy coordination to head off the next financial crisis

- The challenge will be creating conditions that are self-sustaining and which work for all economies, not just a few

But the capital-intensive, productivity-driven corporate sector revival is stalling and forecasters fret about what’s lurking round the next corner.

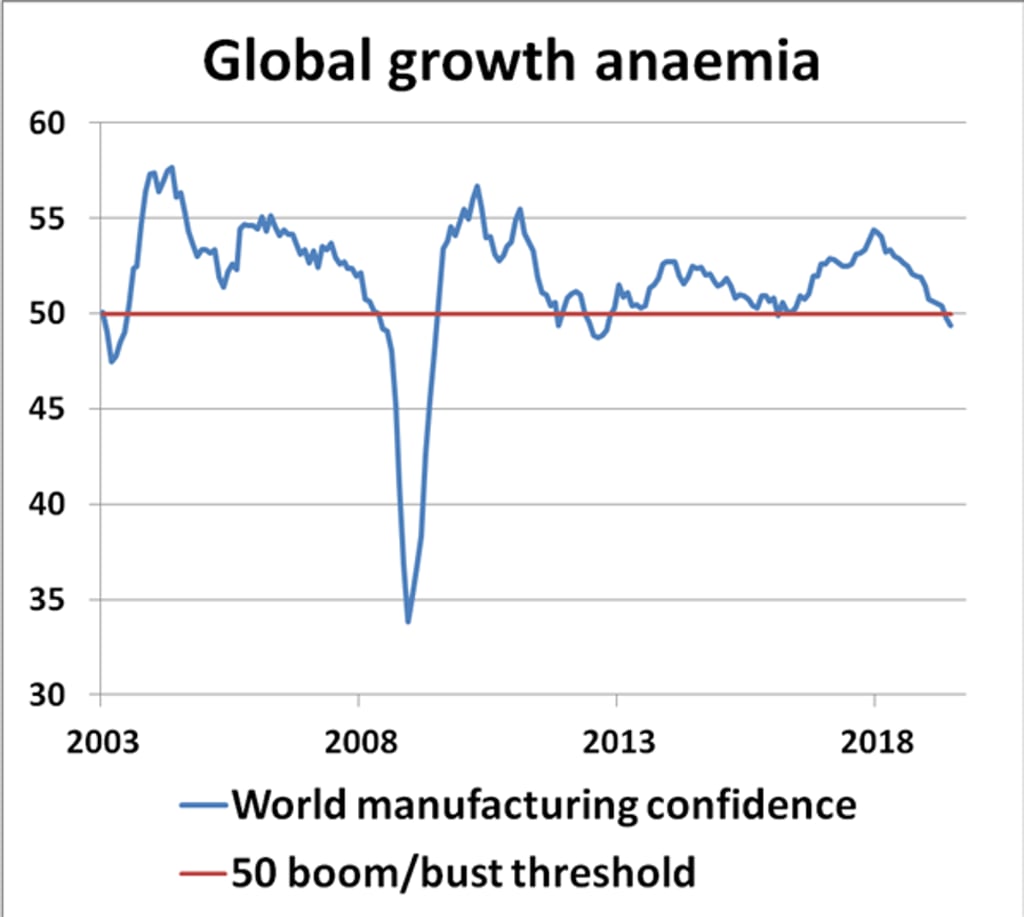

The world has descended into global growth anaemia. It has become pandemic: you can see it at the national level among the major economies and it is sweeping into regional spheres through trade transmission effects. Global economic confidence is becoming increasingly unresponsive and needs a major reboot as soon as possible.

The same applies to all major nations right now. Everyone needs to pull their weight in a way which works in concert, not at odds. The cracks are showing everywhere. The euro-zone economy is heading for trouble, Germany, France and Italy are slowing down sharply and the European Central Bank is under intense pressure to act again soon.

Japan’s economy needs another major reboot, but it’s a challenge for policymakers where to start. The policy cupboard is pretty bare, but the Bank of Japan and the Japan’s Ministry of Finance must start working together to stop Japan’s slowdown from spiralling out of control.