Advertisement

The View | As protests rock Hong Kong, money may flee to safer and cheaper property markets

- For Hong Kong property investors, acute threats to the city’s stability are increasing the appeal of cities like Vancouver and Sydney, where house prices have been brought under control

Reading Time:3 minutes

Why you can trust SCMP

As Hong Kong’s political crisis enters a dangerous new phase, with the protests erupting into violence, the city’s reputation among investors is taking a severe knock. The territory’s rule of law and fundamental freedoms – crucial advantages that have underpinned Hong Kong’s status as Asia’s premier financial centre – are being eroded, raising the spectre of an exodus of capital and businesses from the city.

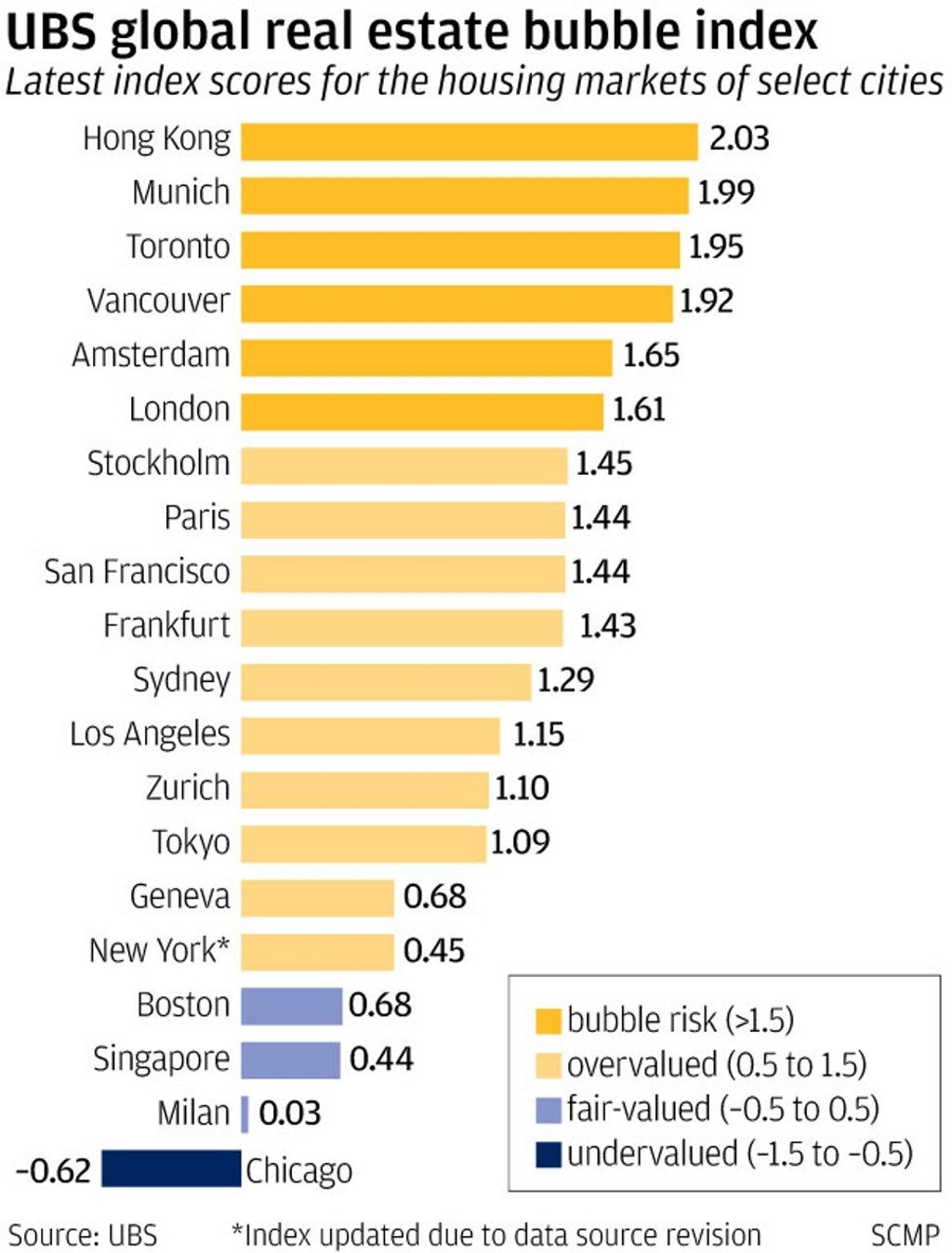

In the property market, the unrest coincides with – and indeed is being partly fuelled by – a continued surge in house prices, which are hovering near record highs, cementing Hong Kong’s position as the world’s most overvalued residential real estate market and pushing the city further into the “bubble risk zone”, according to the Global Real Estate Bubble Index published by UBS last September.

For Hong Kong property investors, two factors – valuations likely to remain stretched for the foreseeable future, mainly due to chronic undersupply, and acute threats to the territory’s political and economic stability – should increase the appeal of prime real estate in other leading cities, especially those where Hongkongers have business and family connections.

Advertisement

Already, Hong Kong investors are showing increasing interest in metropolises which are home to large populations and have recently shown sharp declines in home prices. Vancouver, which is not only the most “Asian” city outside Asia – 43 per cent of its residents are of Asian descent – but also ranks third, after Vienna and Zurich, in the latest Quality of Living survey by Mercer, a consultancy, holds particular appeal.

The property market in Canada’s third largest city has swung firmly in buyers’ favour over the past year, mainly because of a slew of government measures aimed at deflating a housing bubble that saw home values more than double in the decade through 2016, outpacing gains in New York and London.

Advertisement

Advertisement

Select Voice

Select Speed

1.00x