Europe must fix its economy with stimulus to help the people, and member countries, that need it most

- Neither austerity nor supply-side economics that put the haves above the have-nots will pull Europe out of its doldrums

- To rescue the economy, Brussels must help its poorer members and spend on key infrastructure and social services

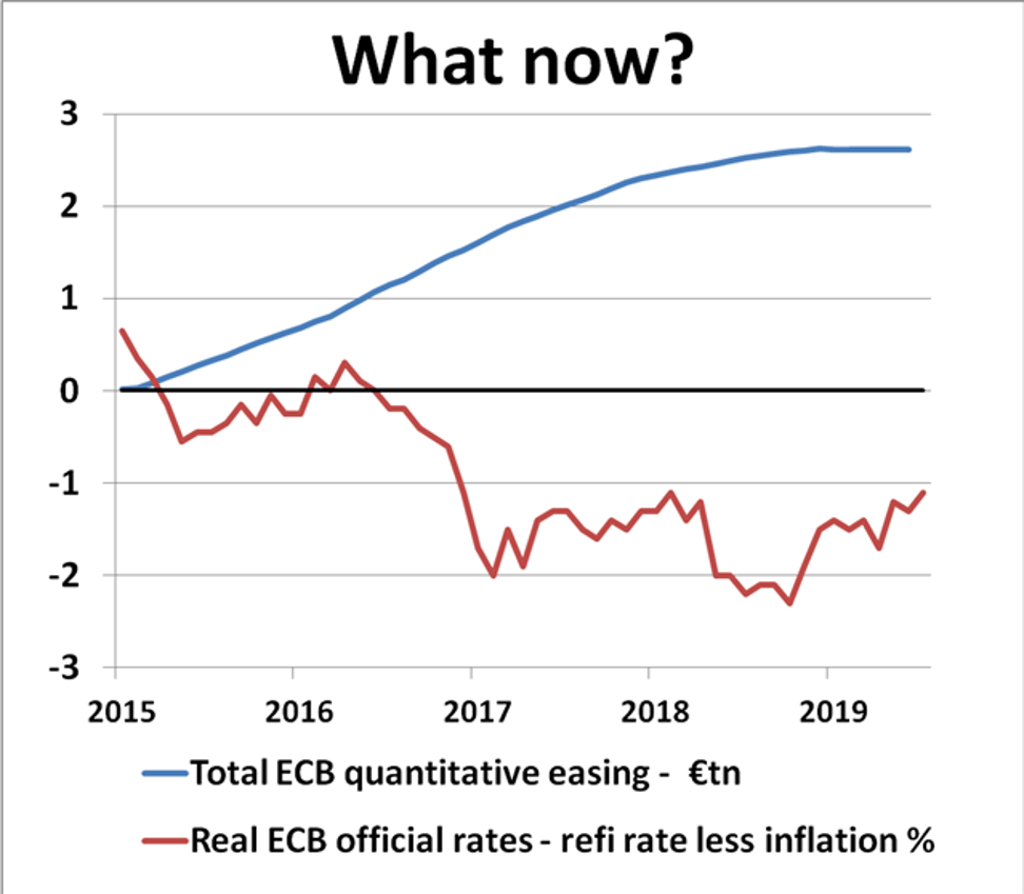

Europe’s monetary locomotive has run out of steam and the European Central Bank is scratching around for ideas on how to reboot recovery and reflate domestic demand. It has three options – cut interest rates again, reopen the doors to more quantitative easing or devalue the euro to boost exports. The ECB has done it before and it can do it again. The problem is that it still has the hallmarks of a temporary fix.

There is another way, of course, which is for governments to reverse fiscal austerity, cut taxes and start spending again. It may be anathema to Europe’s conservative central bankers, but a dream come true for Europe’s populist politicians.

In the absence of any near-term resolution of the US-China trade war, Europe needs to come up with a comprehensive strategy bringing together the best of monetary and fiscal easing, which can not only boost domestic demand and job creation for wealthy leading nations like Germany and France, but can also provide a sustainable recovery for those parts of the euro-zone economy like Italy, Spain and Greece, which are in urgent need of permanent repair.

This means equitable shifts of productive power to the parts of Europe crying out for tax transfers, investment subsidies and radical action plans that can help eliminate disparities of growth, employment and wealth opportunities across the region.