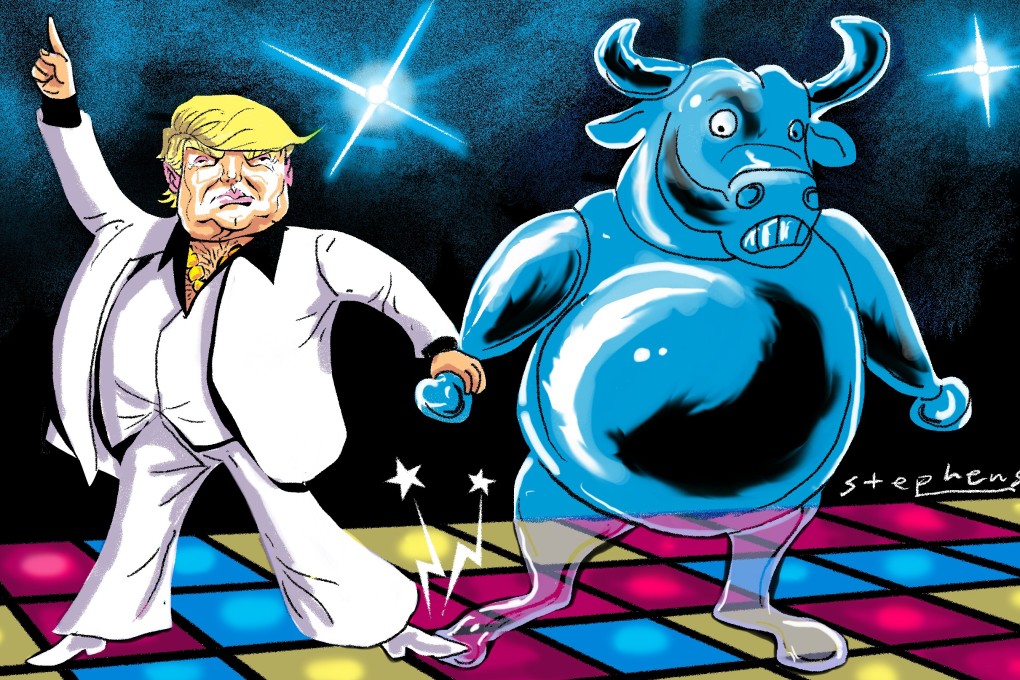

Opinion | Can Trump keep the US stock market bubble from popping as the world economy slows?

- The US president has so far managed to keep the market buoyant by offering economic hope to calm nerves. As China’s economy continues to slow, and more multinationals begin to feel the pain, the tipping point may not be too far off

The US market has gone through another convulsion over recession prospects. Both the market and Trump thought that a Fed rate cut would revive the market. It may have had the opposite effect. The Fed’s move has only magnified the recession fear. Why would the Fed cut rates otherwise?

As the US unemployment rate is still at a historical low, the recession fear may seem odd. But, now is not a normal time. After the 2008 global financial crisis, the global economy has come back with more debt and more asset bubbles. In a bubble economy, recession is a self-fulfilling expectation.

The market bubble pumped up the value of Amercia’s US$30 trillion pension assets, which still has a shortfall of US$3-4 trillion. Like Trump said, if the market pops, Americans could kiss their pensions goodbye. As baby boomers are retiring en masse, massive pension shortfalls will surely lead to recession and even political turmoil.