Advertisement

Inside Out | Inverted yield curves may alarm Donald Trump and the wealthy, but it’s just more stagnation and inequality for the rest of us

- Low interest rates after the 2008 crisis limit our response to the next recession, but that’s not the only problem

- For those who aren’t wealthiest of the wealthy, prevailing low interest rates have meant salaries stagnate and savings evaporate

Reading Time:4 minutes

Why you can trust SCMP

For those who don’t clearly know the difference between an inverted yield curve and a cunning feint by a Boston Red Sox pitcher, you need to remember just two things: it is very bad, and it almost always appears ahead of a big recession.

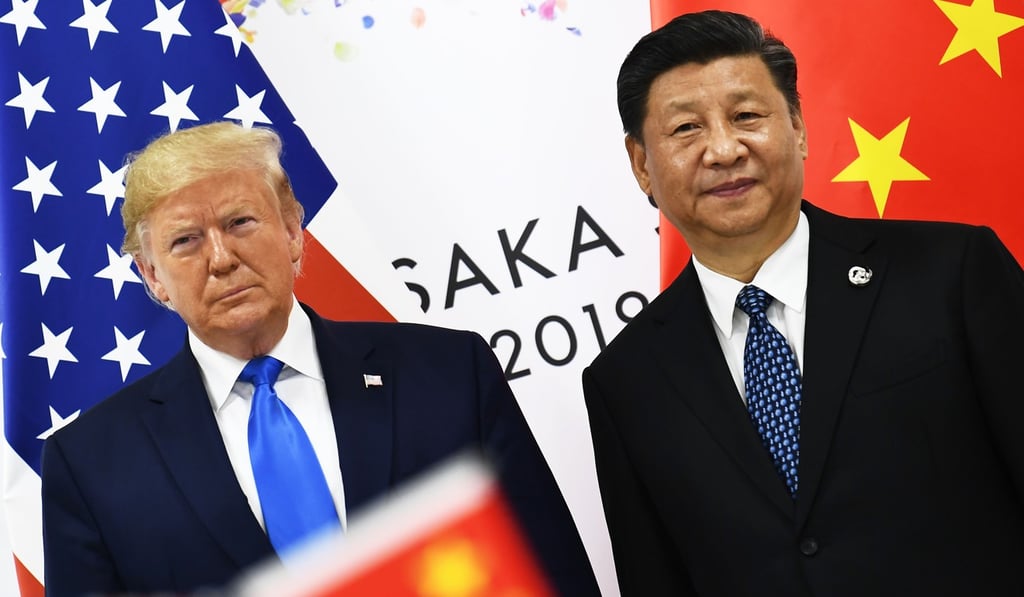

And if Donald Trump tweets “CRAZY INVERTED YIELD CURVE!” – yes, all in capital letters – you know it must be important, at least for his re-election prospects at the end of next year.

Beyond the White House, August’s yield curve inversion set the world’s financial market experts aflutter, in particular around their big annual powwow in Jackson Hole in Wyoming. Put aside Hong Kong’s street protest convulsions, Brexit pyrotechnics, hurricanes destroying the Bahamas and the death of Zimbabwe’s dark prince, Robert Mugabe, and the financial markets could think of almost nothing else.

Advertisement

No one seems to know exactly why an inverted yield curve so reliably predicts an imminent recession, but have no doubt that it does – in particular the two-year, 10-year inversion that happened in August. It seems there are several inversions that stir fear. They include the 30-year, five-year inversion, and the 10-year, three-month inversion. We should fear all of them, but the two-year, 10-year inversion in particular.

Advertisement

So what is this inversion thing? In normal times, if you want to buy a US Treasury Bond, you will earn a better yield – a higher interest rate return – on a long-dated bond than on a short-dated one. Naturally, people think a bond that only matures in 10 years is a bit riskier than a bond maturing in two years, so they expect a better yield on the long bond.

Advertisement

Select Voice

Select Speed

1.00x