Advertisement

Why China’s capital liberalisation needs to be a two-way street

- A greater diversity of investors minimises volatility and subjects Chinese markets to greater scrutiny, strengthening them in the long run. In return, Chinese investors with greater access to overseas markets could diversify their portfolios and bring best practices home

Reading Time:3 minutes

Why you can trust SCMP

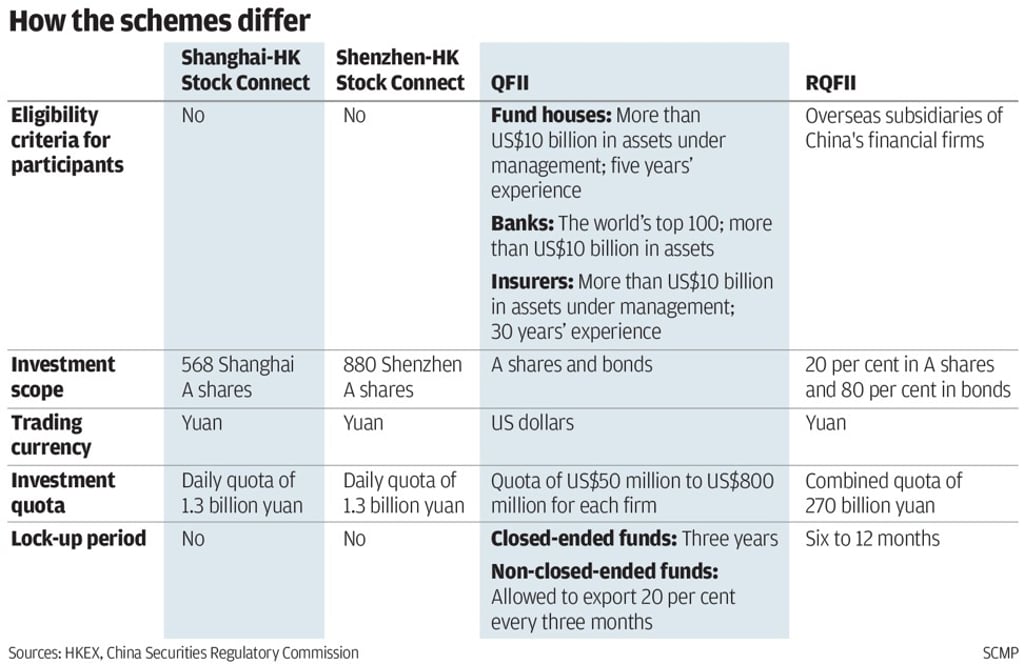

China has been opening up its financial markets to international investors over the past two decades. The removal of quotas for the Qualified Foreign Institutional Investor (QFII) and Renminbi Qualified Foreign Institutional Investor (RQFII) schemes, announced on September 10, is the latest milestone of this liberalisation.

As foreign investors gain greater access to China’s equity and bond markets, it makes sense to allow Chinese investors overseas to also access a broader range of financial assets to diversify their portfolios. Facilitating this two-way capital flow will help speed up development of Chinese financial markets.

The latest announcement is not an attempt to give onshore stock and bond markets a quick boost. Before they were removed, only about one-third of the QFII and RQFII quotas had been utilised. Foreign investors can also access Chinese markets via stock connect schemes (Hong Kong-Shanghai, Hong Kong-Shenzhen and London-Shanghai) and the bond connect scheme.

Advertisement

However, abolishing the quotas means investors can buy as many Chinese onshore equities or fixed-income products as they wish, subject to foreign-exchange requirements. This is crucial for both asset classes to see greater representation in global equity and bond indices, such as the MSCI Emerging Markets Index for equities, and the JPMorgan Government Bond Index-Emerging Markets Global Diversified Index for fixed income.

Advertisement

International investors’ presence in China’s onshore market is small. They represent around 3 per cent of capitalisation for the equities market and 2 per cent for the bond market. Boosting their presence would diversify China’s investor base, which is dominated by local retail investors, and dilute the tendency for a herd instinct, and so better manage market volatility.

For example, a bear market in the US is defined as a 20 per cent correction in the stock market, and this happens every 10 years on average. In China, a market drop of this magnitude happens every 18-24 months.

Advertisement

Select Voice

Choose your listening speed

Get through articles 2x faster

1.25x

250 WPM

Slow

Average

Fast

1.25x