Advertisement

Under threat of impeachment, Trump should aim for a win on the economy – by ending the US-China trade war

- There’s no better way for Trump to fight off the threat to his presidency and increase the chances of his re-election by focusing on improving the American economy and global outlook. The damaging trade war must end

Reading Time:3 minutes

Why you can trust SCMP

Financial markets might think otherwise, but the threat of impeachment of President Donald Trump might turn out to be the best outcome for the US economy.

US growth has hit an impasse and is in need of a lift. The trade war with China is taking a heavy toll on America’s economy and dashing hopes for a stronger recovery. There may only be an outside chance of a recession but it shouldn’t be ruled out entirely. Trump must start focusing on his domestic agenda and refrain from further friction with political foes at home and abroad.

With his popularity ratings languishing, the threat of impeachment should be a good incentive to refocus his energies on improving the health of the domestic economy. It’s not rocket science: a stronger economy and a better sense of well-being among voters would be the best way to get re-elected next year.

Advertisement

On the surface, things don’t seem so bad. Last week’s US jobs data for September showed unemployment hitting a 50-year low and new hiring conditions still in good shape. But if economic confidence is a bellwether for future growth, there are problems ahead. US consumer, business and financial market confidence are all giving a worrying thumbs-down to Trump’s economic stewardship.

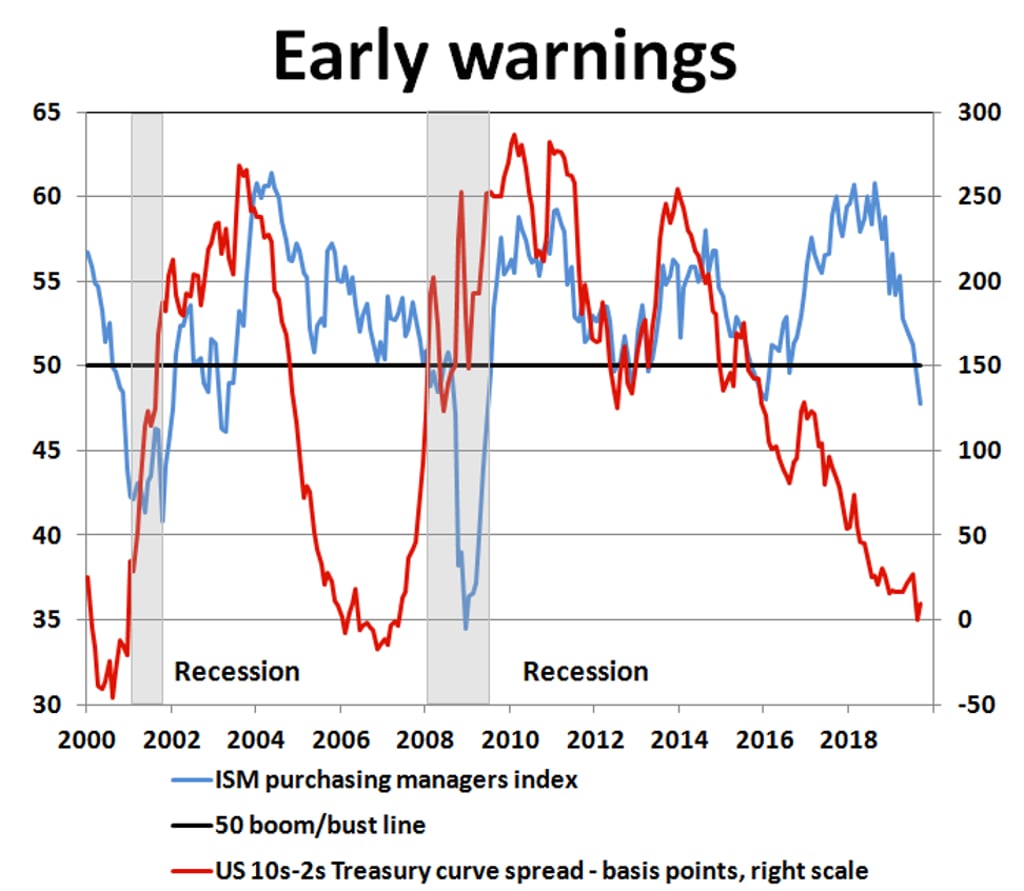

Consumers are worried about the consequences of the trade war, business optimism is at its lowest ebb since the 2008 financial crisis and the US Treasury yield curve has been sounding recession warnings for months. The economy and markets need better inspiration.

Advertisement

The US economy is running well below capacity, with second-quarter GDP growth slowing to 2 per cent, when it could easily be expanding above 3 per cent, considering the vast array of monetary and fiscal aid pumped in after the 2008 crash.

Advertisement

Select Voice

Choose your listening speed

Get through articles 2x faster

1.25x

250 WPM

Slow

Average

Fast

1.25x