After trade war progress, the Fed should cut interest rates, boost its QE holdings and lower the dollar’s value to boost the US economy

- The Federal Reserve should not only cut interest rates, but up its quantitative easing holdings, thus driving down the dollar. This, and a trade war ceasefire, would not only boost the US economy but the global economy and trade as a whole

It may be a bad idea submitting to political pressure to cut US rates, but the Fed can ill-afford to tinker at the monetary margins while the economy is treading water. Time is running out; the Fed has plenty of options but needs to use them fast.

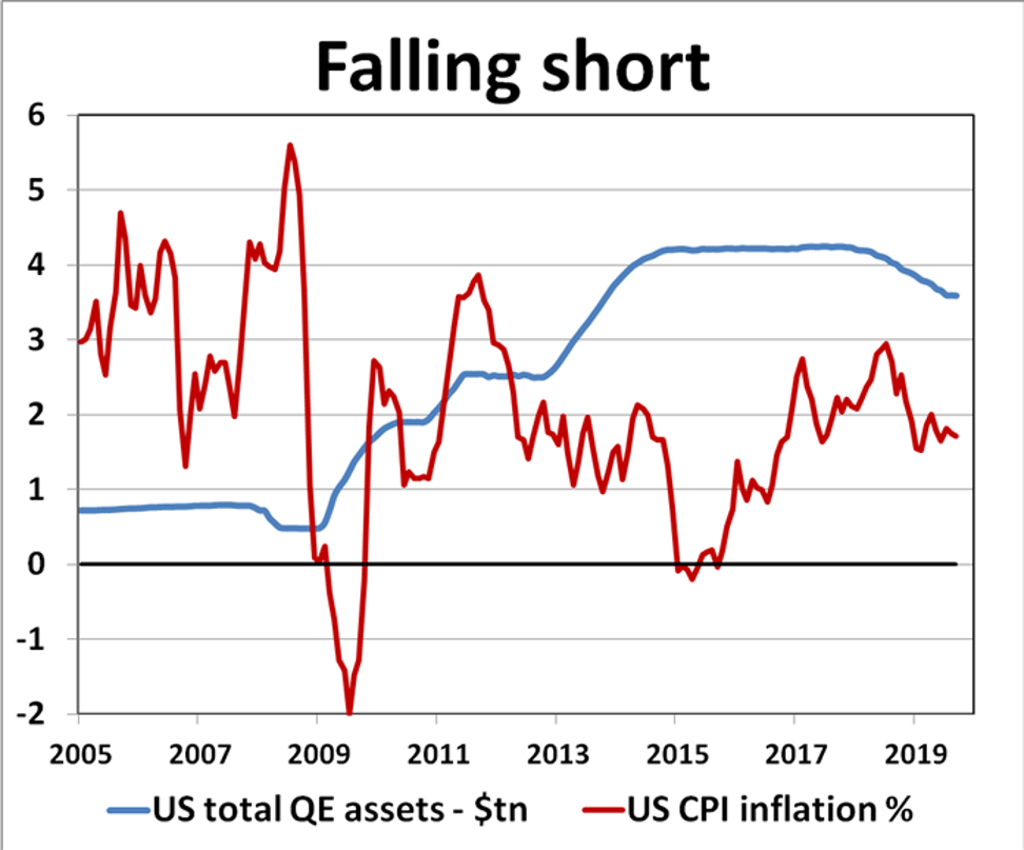

The Fed continues to fall short on what’s needed to get the US economy back to full strength. The latest announcement, that it is due to start buying short-dated Treasury bills, is unlikely to set the world on fire, especially since the Fed insists the move is nothing more than a technical smoothing operation to iron out some short-term liquidity glitches.

It has stressed it’s not a resumption of quantitative easing (QE), the programme of bond buy-backs and money-printing which helped jump-start the US economy after the 2008 crash. If so, it is wasting a valuable opportunity.

The Fed has to use more gumption to get the economy moving up a gear. Much lower interest rates, more QE and a weaker US dollar could easily pull the economy out of the doldrums of 1-2 per cent growth and into a more favourable 3-4 per cent range.