Advertisement

What the US, China and the rest of world need now is even more Fed stimulus

- The US central bank is cutting interest rates and buying short-term Treasury bills with the aim of supporting the economy. This should give China more room to ease policy and stabilise the yuan, taking some heat out of the trade war

Reading Time:3 minutes

Why you can trust SCMP

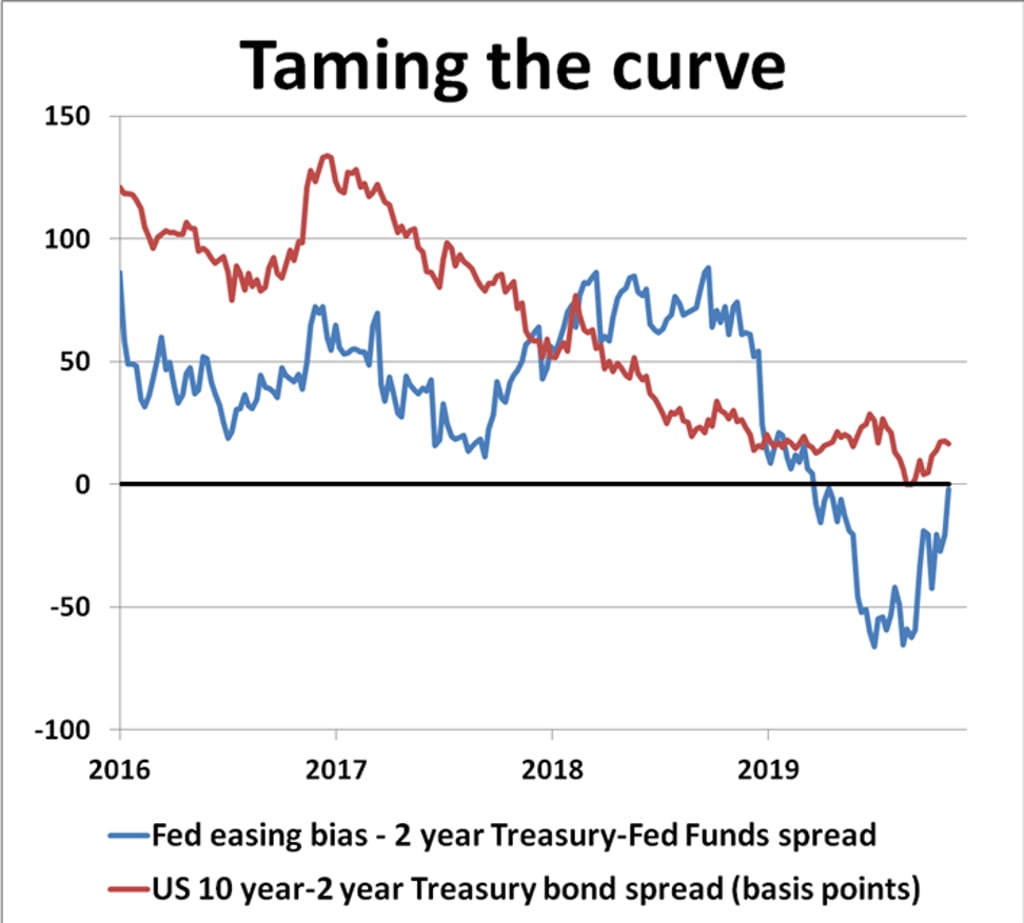

The US Federal Reserve seems to have pulled off a policy coup, delivering a third rate cut last week, calming expectations of future easing, but still providing plenty of cheer for markets. So what’s to worry about?

Quite a lot, actually, judging by the build-up of unresolved domestic and global risk factors. The impeachment threat against US President Donald Trump, the endless Brexit crisis in Europe and the US-China trade war are all signs of potential trouble facing the Fed.

The US economy needs more support, and there is pressure on the central bank not only to sort out domestic money market tensions but also to steady global financial conditions. The key worry is whether the Fed has sufficient firepower to finish the job.

Advertisement

The central bank is a long way from policy normalisation. The world is still badly scarred from the 2008 financial crash and global demand warrants more attention. Thankfully, the chances of a US or global recession seem slim but the Fed has clearly been rattled enough by recent trends to recognise that more stimulus may still be necessary.

The trouble is that with US policy rates currently so low – in the 1.5 to 1.75 per cent target range – the Fed has little room to manoeuvre, which is why additional quantitative easing and further asset purchases will be necessary to finish the job.

Advertisement

Advertisement

Select Voice

Choose your listening speed

Get through articles 2x faster

1.25x

250 WPM

Slow

Average

Fast

1.25x