Why the coronavirus threat, new trade barriers and massive global debt will not dampen stock markets

- Central banks seem committed to loose monetary policy, which means the wall of money they have created since the 2008 financial crisis needs to find a home

- Negative yields in mainstream bond markets, meanwhile, will push investors towards equities

Multilateral accord may seem thin on the ground, just at the moment when there’s a dire need for a bigger collective effort to finish the job which began in the dark days of the 2008 financial crash. But getting the global economy back on track for durable, sustainable recovery is just as imperative now as it was over a decade ago. It’s definitely time for more meaningful action.

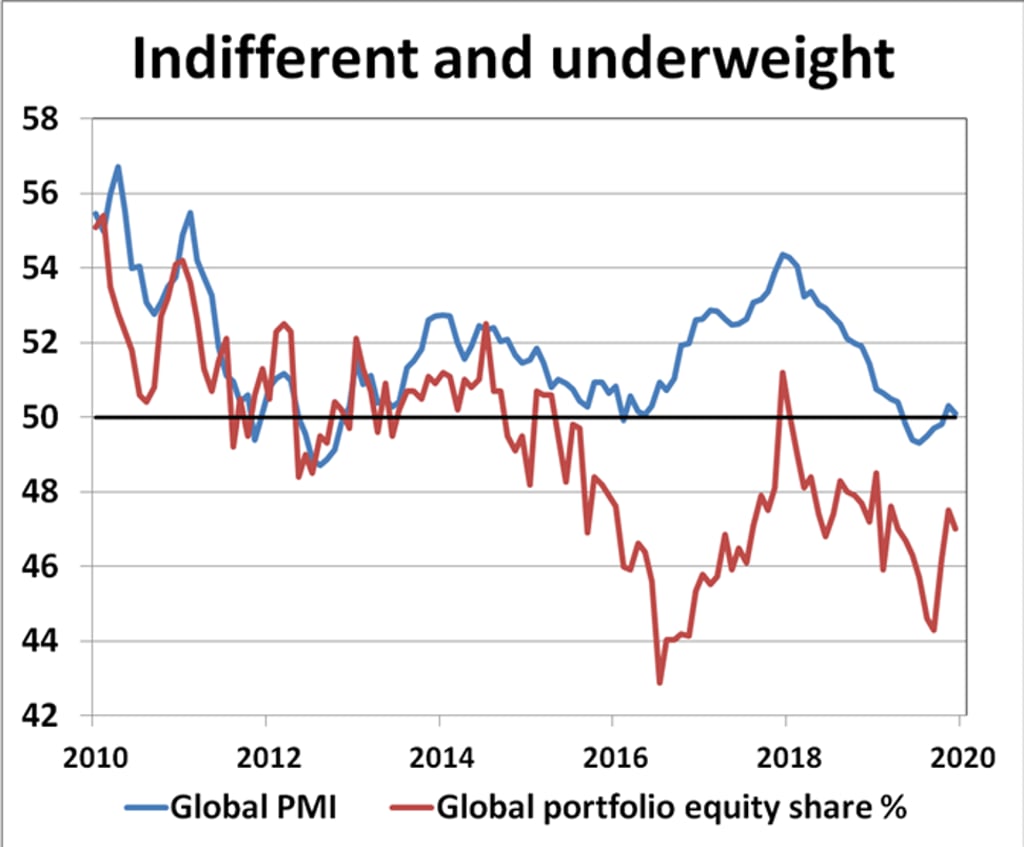

After all, this is supposed to be the year that global recovery gets back into gear. It may be early days but global confidence is floundering, global stock market sentiment appears to be at the top end of the equity cycle and investors are beginning to find all sorts of excuses to be more cautious.

On the positive side, none of these problems should be insurmountable and patience should be rewarded. Sophisticated financial economies are used to challenging circumstances and global policymakers, not least the major central banks, should have it covered.