Coronavirus threat should push global superpowers to ditch austerity and ramp up fiscal stimulus

- As the coronavirus takes its toll on a global economy already battered by the US-China trade war, central bank monetary policy easing will not do the trick

- In Europe, where interest rates are already negative, only massive public spending will prevent Germany, France and Italy from heading into recession

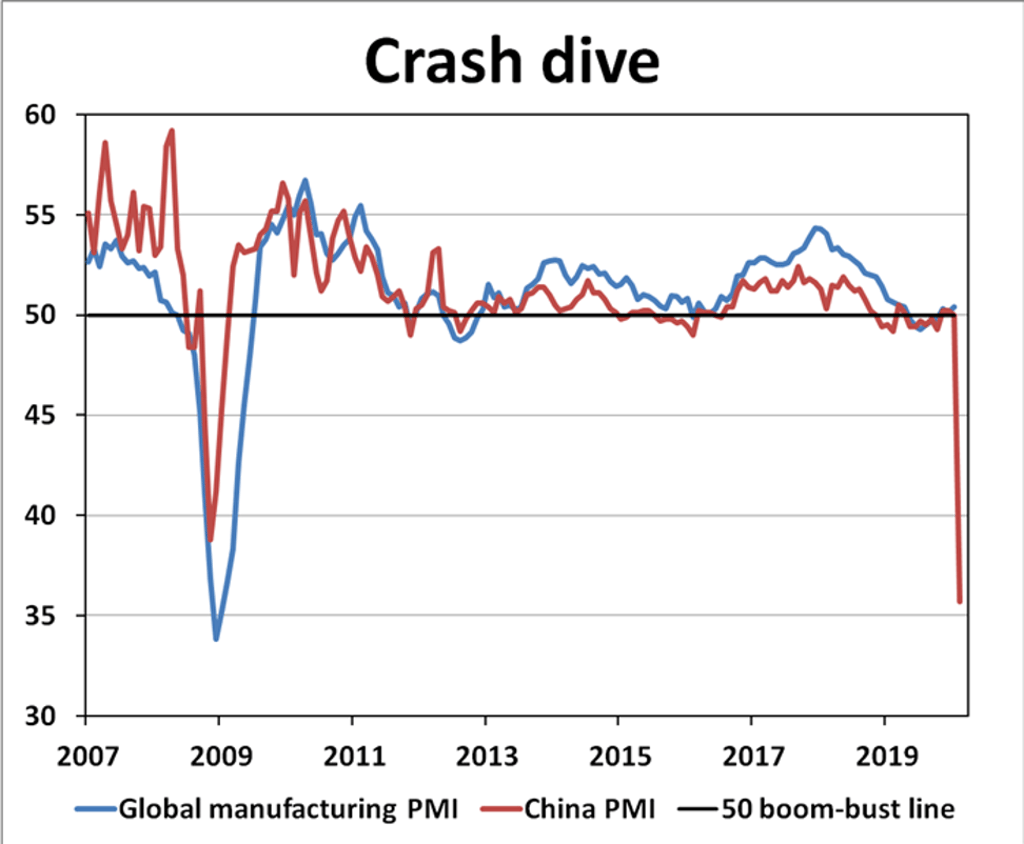

China’s economy is a weather vane for the rest of the world and a warning that it’s time for governments around the globe to go on the offensive and ramp up spending to cool the rising panic. It is pointless to expect central banks to take the strain with looser monetary policy; global superpowers need to lead by example and pump up the world economy with a lot more fiscal stimulus.

The recovery from the 2008 financial crash proved the global economy can be resilient and will bounce back, but world policymakers need to spend their way to faster recovery first.

It’s time to dump budget austerity in favour of global fiscal reflation. World stock markets have seen upwards of US$7 trillion wiped off share values over the past few weeks and the major industrial nations will need to stump up several trillion dollars of extra stimulus in the months ahead to make up for the hit to wealth expectations and economic confidence.