Why the coronavirus pandemic will turbocharge investment in data centres

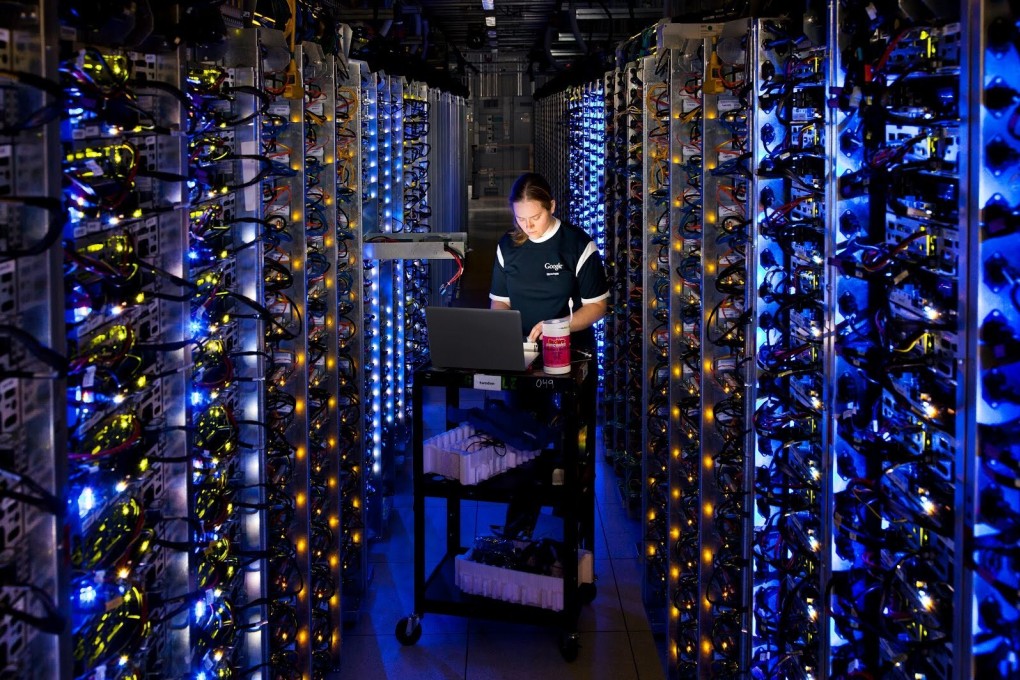

- The turn to digital infrastructure during the Covid-19 pandemic has boosted the existing boom in investor interest in data centres

- Given that data centres are capital-intensive and require significant technical expertise, investors could consider investing directly in the operating company itself

The latest data on investment activity paints a grim picture of Asia’s real estate market. Last Thursday, JLL announced that transaction volumes across the region plunged 32 per cent year on year in the first half of 2020, with the decline in deals accelerating sharply in the second quarter.

The fallout from the Covid-19 pandemic led to a staggering 68 per cent drop in transactions in Singapore last quarter, an even sharper fall than in Hong Kong, the hardest hit market in the region over the past several quarters.

JLL attributes the slump partly to the huge uncertainty surrounding the strength of the post-lockdown recovery. Yet, it also notes that “defensive and operation-critical assets” are attracting significant interest as investors target properties with stable cash flows.

03:02

China sees boom in transactions for used goods as coronavirus hits retail sector

In a sign of the extent to which the warehouse-like facilities are popular among investors, United States data centre real estate investment trusts delivered total returns of nearly 20 per cent in the first half of this year, compared with negative returns for retail and office Reits of 37 and 24 per cent respectively.