Is Europe’s stimulus spending out of control? One way forward is to patch up trade relations with China

- The amount of money earmarked for European recovery is huge, with scant regard for the consequences

- Both the European Union and China need more bilateral trade to stand any hope of a stronger recovery this year, but concessions and compromise will be needed

But it was really another case of the classic European fudge and desperate last-minute wrangling and, already, political cracks are beginning to appear.

If it’s a question of spreading the jam very thinly, then the door is left wide open for future bailouts to bolster Europe’s tottering economy down the line.

The worry is that Brussels’ stimulus spending is running out of control. The amount of money earmarked for European recovery is huge, with scant regard for the consequences. Much of Europe is steeped in recession, inflation is close to zero and the coronavirus crisis is far from over. Economic demand remains dead in the water and the big issue is who will pick up the bill for reflation.

00:55

EU ‘deplores’ China’s decision to enact national security law for Hong Kong

The combined budget deficits of euro-zone governments for the 2020 financial year could amount to an estimated €1.3 trillion, roughly the same as the €1.35 trillion the ECB has pledged to inject into the system over the next year. Europe is living beyond its means and monetising more debt.

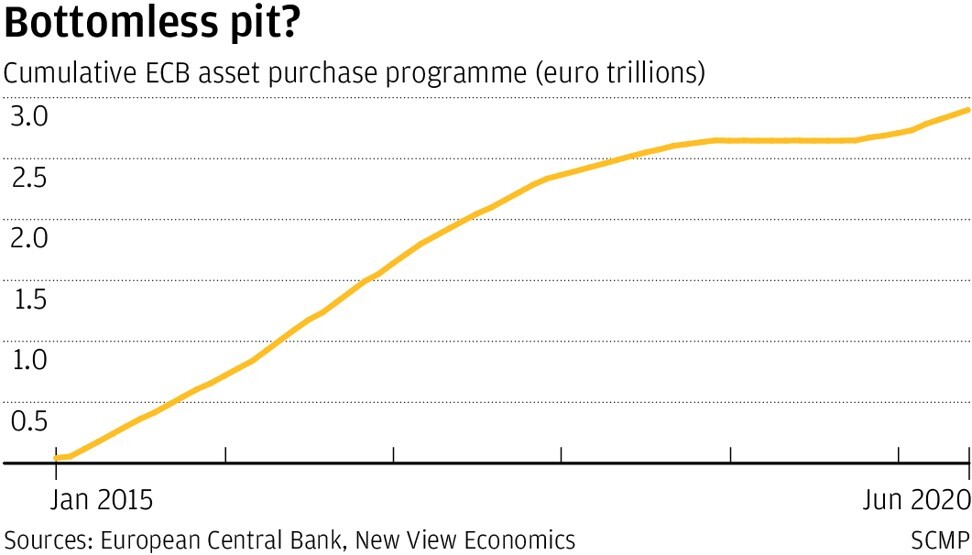

In Germany’s view, the ECB’s asset purchase programme was never intended to be a bottomless pit of money printing. German Bundesbank president Jens Weidmann thinks the decision by European leaders to issue joint debt to finance coronavirus aid should be an exception rather than the rule, and should not serve as a blueprint for the future.

The EU-China courtship is flagging. Here’s how to rekindle relations

The €3 trillion in bond purchases already accumulated by the ECB since the inception of QE in late 2014 sits uncomfortably with Europe’s monetary hawks and, as such, shouldn’t be relied on to extend forever. In their view, debt monetisation is an anathema for ECB credibility and negative for the euro.

It is no surprise that the euro’s post-deal rally has been so muted in the past week, moving only two big figures to 1.1650 versus the US dollar. The rally is more of a mild short squeeze than a battle cry for better times ahead.

With Europe’s economy on the ropes and European politics becoming more inwardly focused, Washington and Beijing must be left wondering what hopes remain for a thawing in future tripartite trade relations.

Trade frictions between Europe, the United States and China have worsened so much in recent years that a breakthrough is needed soon if the global economy and world financial markets are to stand any chance of a sustainable recovery.

01:49

Human activity on Earth half as noisy during Covid-19 pandemic lockdowns

While it’s tempting to focus on domestic solutions, the way to a longer-lasting global recovery lies in a much more stable and secure world.

David Brown is the chief executive of New View Economics