Advertisement

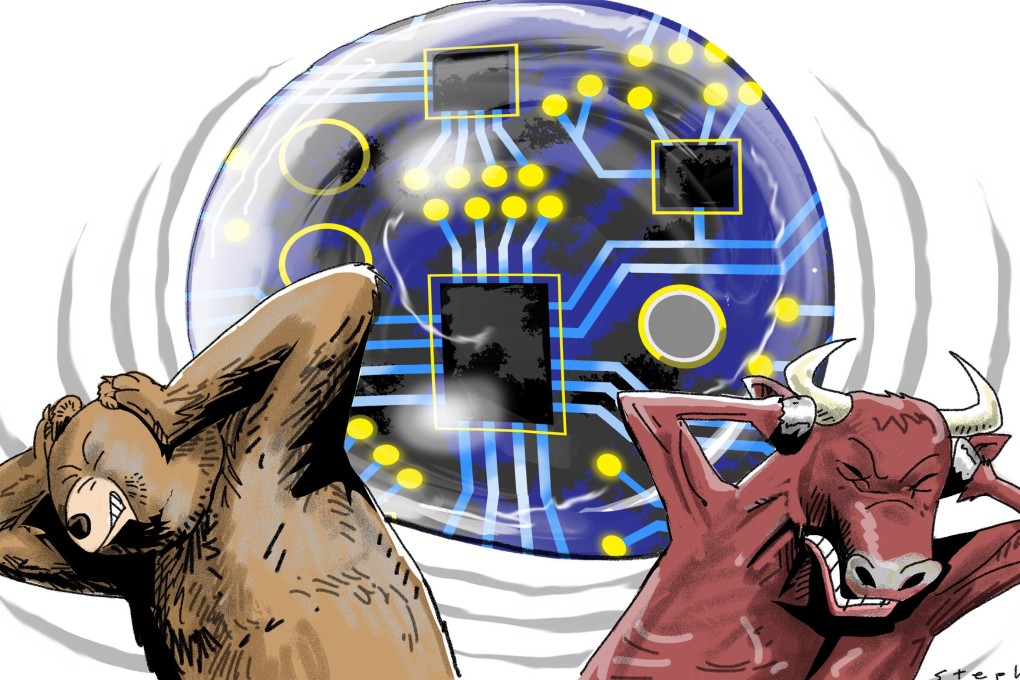

Opinion | Beware: the US-China technology war is about to burst the tech bubble

- Tech stocks are overvalued, thanks to central banks. And as the impact of the US-China tech war becomes increasingly obvious and the pandemic cools demand for hi-tech goods, a chill will be thrown over stock markets

Reading Time:4 minutes

Why you can trust SCMP

The US tech war with China is heating up, and it isn’t looking good for the tech bubble. The technology war will depress demand for the foreseeable future and increase business costs for all participants. The tech bubble is still floating high, with tech stocks surging as central banks boost liquidity in response to the pandemic.

But as the impact of the tech war becomes increasingly obvious over the coming quarters and earnings reporting seasons, a chill will be thrown over stock markets. There might not be enough liquidity to neutralise fears over deteriorating fundamentals. When this tech bubble bursts, the popping sound could be louder than in 2000 and send more shivers through financial markets than the crisis in 2008.

The world is seeing the biggest tech bubble in history. Look no further than Apple, which has reached US$2 trillion in market value. Even though Apple is a good company with a sustainable business model, its core business of mobile phones is a sunset market. Given that it is already a tech giant, how much room is there for growth? Yet its price-to-earnings ratio – close to 40 times – is its highest in a decade, which just doesn’t make sense.

Advertisement

The valuation of other tech companies makes even less sense. Tesla may be the world’s largest car company by market value, but it is actually a small company by revenue in an industry – and a segment of the industry – with massive overcapacity. Uber is a ride-hailing business that can grow rapidly only by slashing prices. Companies like Facebook and Google profit from collecting data and are increasingly coming under regulatory scrutiny. It is doubtful that their business model is sustainable.

Excessive liquidity is the reason for the massive bubble. Some might still remember the Y2K bubble. Back then, the world was seized by the fear that all computers would stop working at midnight on December 31, 1999.

Advertisement

Advertisement

Select Voice

Select Speed

1.00x