Advertisement

The View | Why Hong Kong’s office market is having a better pandemic than its residential property sector

- The resilience of Hong Kong’s housing prices, the result of ultra-low interest rates, masks its fundamental problem of a lack of affordable housing. Covid-19 stimulus money is inflating home values without providing a foundation for recovery

- By contrast, the office market is more in sync with economic conditions

Reading Time:3 minutes

Why you can trust SCMP

Since the Covid-19 pandemic erupted in February, Hong Kong’s residential property sector has proved remarkably resilient, living up to its reputation as the Teflon market in periods of severe turmoil.

Despite an economy mired in what is expected to be its deepest recession on record, an unemployment rate that has shot up to its highest level in 15 years and concerns over the city’s future as Asia’s premier financial centre, house prices and sales have held up extremely well.

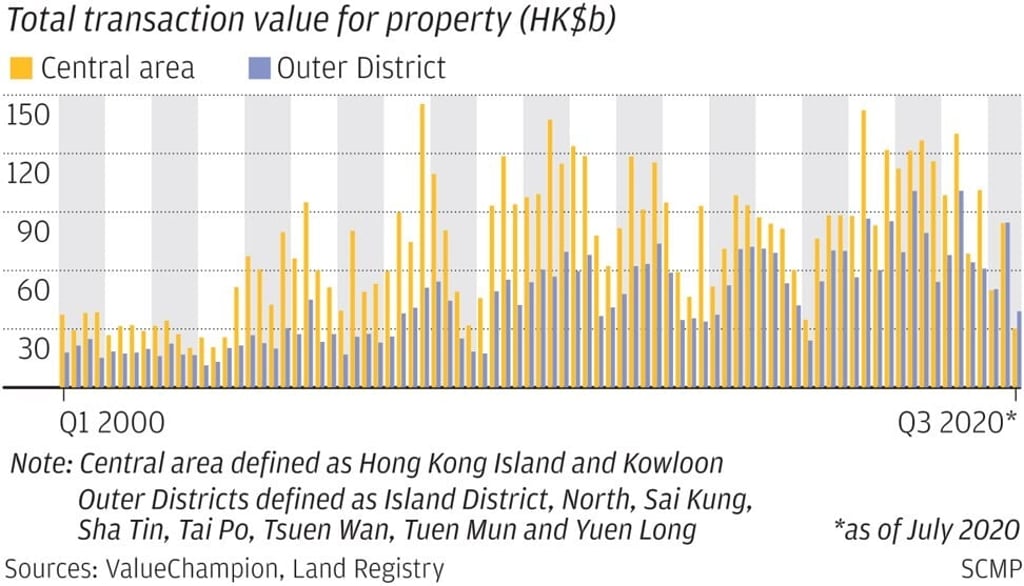

According to Savills, mass residential prices rose 3.5 per cent in the first three quarters of this year, while luxury property values dipped only 5 per cent. More tellingly, although sales in the mass market – homes below HK$10 million – fell 10 per cent, transactions at the top end of the mass market dropped just 5 per cent, with most of the decline coming in sales below HK$5 million.

Advertisement

Commercial property, on the other hand, with the notable exception of the e-commerce-driven logistics sector, has been hit hard. Key gauges of performance in the office sector have plumbed new lows. In the third quarter of this year, net absorption of Grade A office space contracted by 633,000 sq ft, the lowest quarterly level on record, according to data from Cushman & Wakefield.

The decline in leasing activity has been sharpest in the Central district, where occupancy costs remain the highest in the world. Separate data from CBRE shows that the drop in demand in Greater Central (which includes the Admiralty and Sheung Wan districts) accounted for over two-thirds of the fall in net take-up last quarter. With Central’s vacancy rate at its highest level in 15 years, prime rents in the district are expected to drop by 25 per cent this year.

Advertisement

Advertisement

Select Voice

Select Speed

1.00x