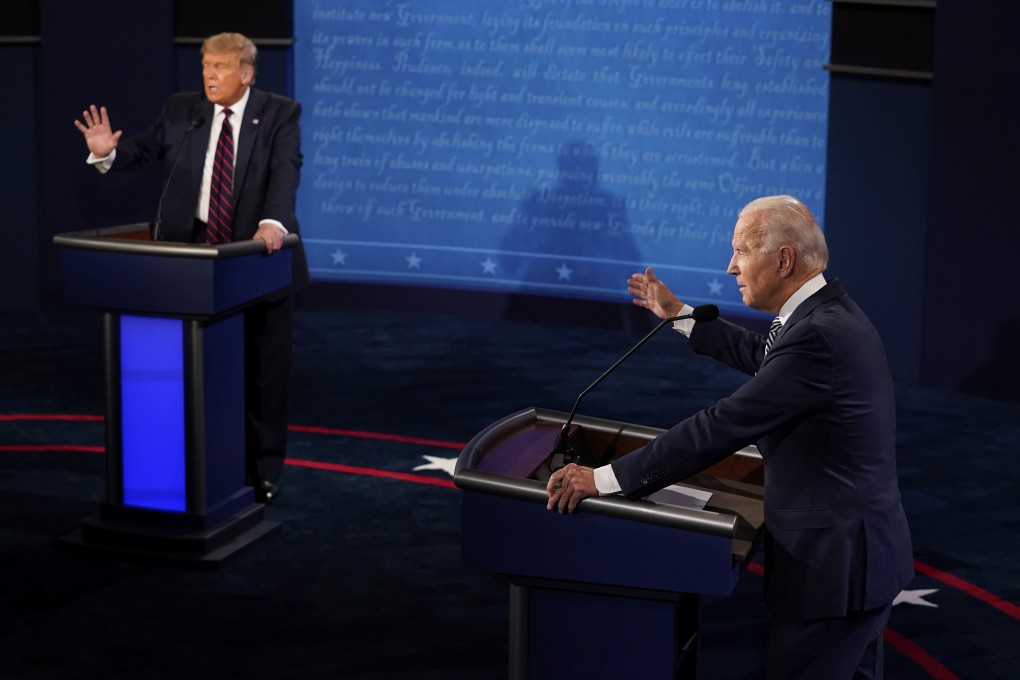

Donald Trump or Joe Biden: how different US election outcomes could play out in markets and in China

- A disputed US election would be unnerving for markets. A Biden victory, coupled with a split Congress, could be troubling for the US, but it would be an opportune time for China to lure investors away

But with the diverging performance of the two candidates, the market’s attention is increasingly turning to and focusing on two issues beyond the presidential election itself.

Whether the presidential election will be disputed depends, first and foremost, on how close the result is. If Biden’s commanding lead in the polls translates into a landslide victory, it will be difficult for Trump and the Republicans not to concede defeat.

Here are a few scenarios of what could transpire on November 3, along with possible market reactions.

02:47

Donald Trump continues to downplay severity of Covid-19 as more US officials report infections

First, a Biden win and a Democratic sweep in Congress: that would be positive for equity markets, removing uncertainty about policymaking in the next four years.