Opinion | Why Singapore’s real estate investors are a force to reckon with globally

- Their appetite for overseas acquisitions remains undimmed despite the pandemic. In fact, the global expansion of the city state’s buyers encapsulates many key drivers of Asian cross-border real estate investment

In global real estate investment markets, one consequence of the Covid-19 pandemic has been a drop in cross-border transactions as lockdowns and travel restrictions impede deal-making. Countries whose property markets are heavily dependent on sources of foreign capital have suffered the most.

In Asia, Singapore has been at the sharp end of the decline in cross-border investment. As one of the markets most reliant on overseas investment, the city state experienced a 60 per cent year-on-year drop in transaction volumes in the first three quarters of this year, data from JLL shows.

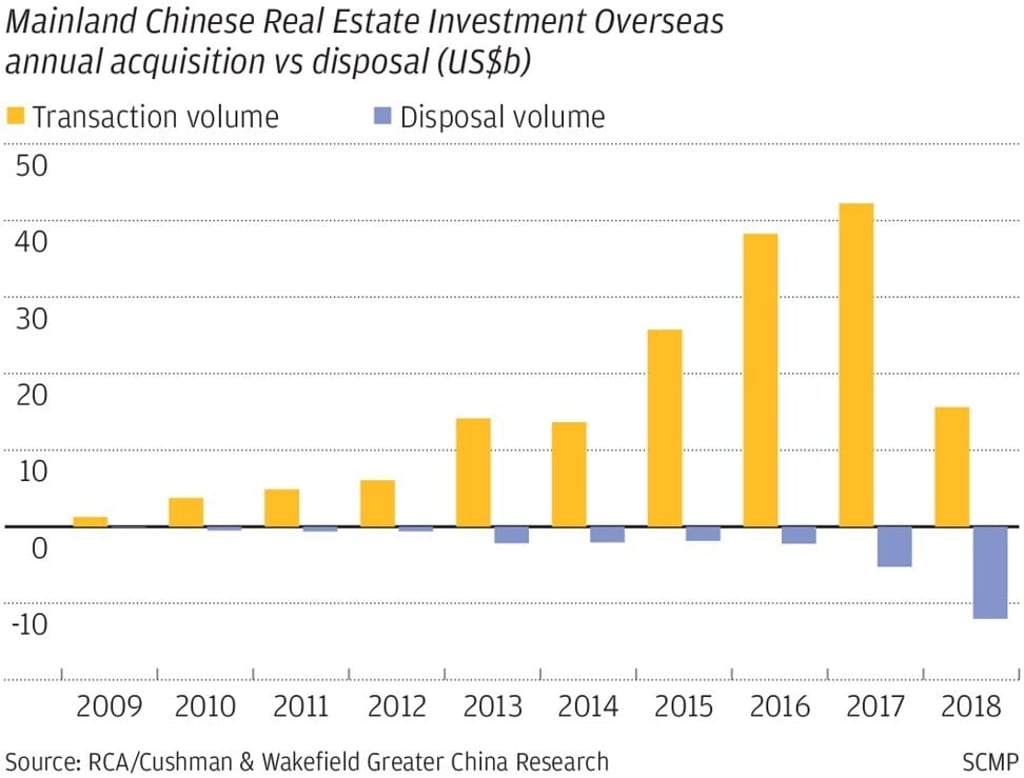

While Singapore accounted for slightly less than one-fifth of Asian outbound investment in 2016-17 – when China was the region’s most active buyer overseas – its share stood at a remarkable 42 per cent in the first three quarters of this year, data from JLL shows.