Why China will have a tough time decoupling from the US dollar

- When weighed against the risks, US Treasuries still offer the best returns for China’s massive reserve stockpile. Diversifying into the euro and yen, for example, would mean giving up yield

China’s exports are booming, overseas earnings are rising at a rapid rate and China’s foreign exchange reserves keep on growing. China has to invest its reserve assets somewhere and US Treasury securities still seem the best option. US political risks have receded with Donald Trump out of the White House and Joe Biden’s presidency offering better prospects for international stability.

More importantly, the US Treasury market offers the biggest, deepest and most liquid bond market in the world for China to invest in. If Beijing wants the best value for its overseas reserve assets, there is no better place.

A fund manager’s fiduciary duty is to maximise portfolio returns under reasonable risk expectations and the best possible prudential standards. Whether it is in the private or public sector, fund managers still need to get the best value out of their investments.

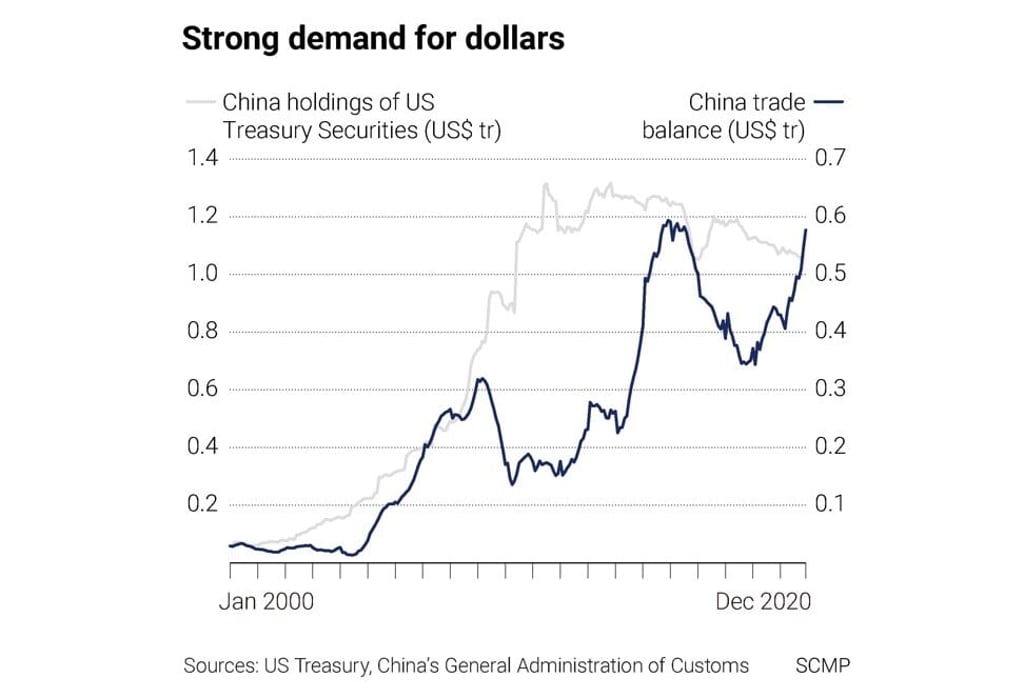

For China, it is a massive undertaking, allocating its reserves stockpile across global markets profitably, securely and efficiently. In recent years, Beijing seems to have been moving away from US Treasury bond investments, with holdings of Treasury securities falling from a peak of US$1.3 trillion at the end of 2013 to just over US$1 trillion at the end of 2020. That’s not a dramatic shift, but the trend is still down.