Macroscope | On financial risk, People’s Bank of China is more credible than the US Fed

- In draining cash from the banking system ahead of Lunar New Year, the PBOC is sending a message of caution. In contrast, the Fed is underplaying the connection between cheap credit and a stock market frenzy in the US

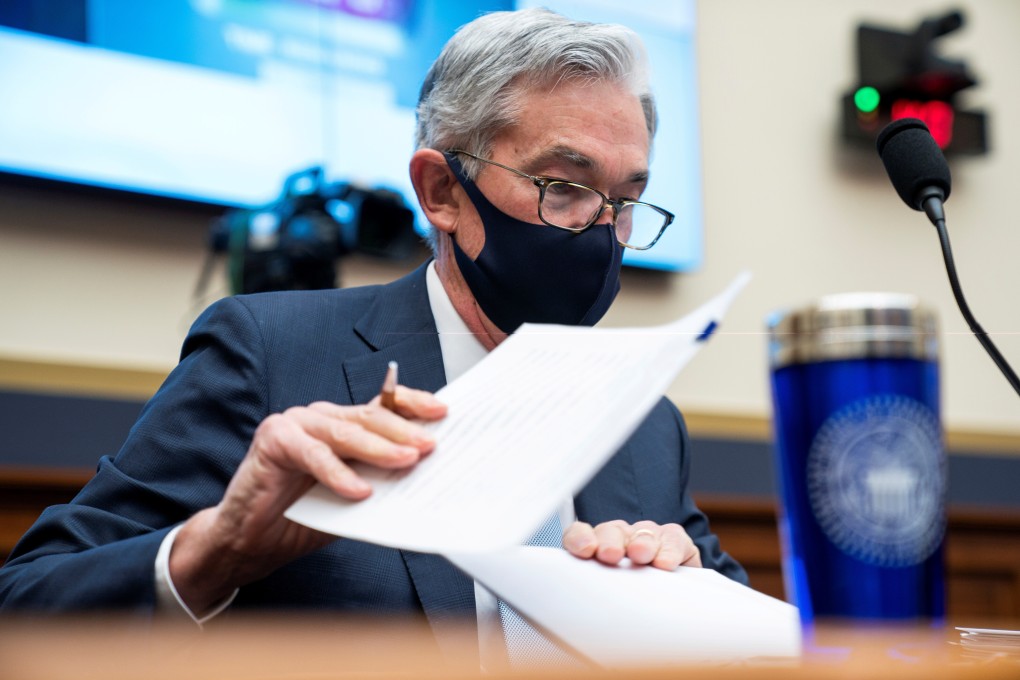

The US Federal Reserve and the People’s Bank of China are on diverging monetary paths, calibrating policy to fit the needs of the American and Chinese economies respectively. But investors may decide that it is the PBOC’s stance that has the greater credibility, and credibility matters to markets.

As it stands, the Fed is unable to look beyond the current economic emergency. Ultra-loose monetary policy settings remain the order of the day even though they may have undesired side-effects that will ultimately create new problems if unaddressed.

In contrast, the PBOC has been pointing out the need to address the unintended consequences of pandemic-related monetary policy accommodation before they get out of hand.

03:29

China investment should follow Westphalian principles, says Nobel laureate Paul Romer