Advertisement

Macroscope | Day of reckoning is coming for coronavirus pandemic debt. The only question is when

- Global debt hit a record US$281 trillion by the end of 2020. For many countries in increasingly dire straits, it’s a case of can’t pay, won’t pay

- For the person in the street, this could mean higher taxes and greater austerity as governments are forced into spending cuts to balance the books

Reading Time:3 minutes

Why you can trust SCMP

1

One of my stand-out memories of the 2008 crash and its aftermath was a sign held by an Irish protester against the severity of the International Monetary Fund and European Union’s bailout terms imposed on Ireland in 2010 during the European debt crisis. The sign read, “Who’s going to pay? Not just me, but my children and my children’s children.”

It wasn’t just the future cost of repaying 85 billion euros (US$112.6 billion) of bailout money which was the worry, but the damage wrought on Ireland’s economy by enforced austerity, debt deflation and severe balance sheet restructuring. This was simply a microcosm of the shock waves being felt around the world at the time.

Now, history is repeating itself with the scourge of the Covid-19 pandemic. The cost of the crisis is growing, government debt is piling up and, at some stage, someone is going to have to foot the bill.

Advertisement

To deal with the pandemic, governments around the world are spending like there is no tomorrow and, together with central banks, ripping up the rule books on how to fund it. Policy conservatism has gone out of the window, and the new norm is huge amounts of deficit spending and debt issuance largely being monetised by the central banks.

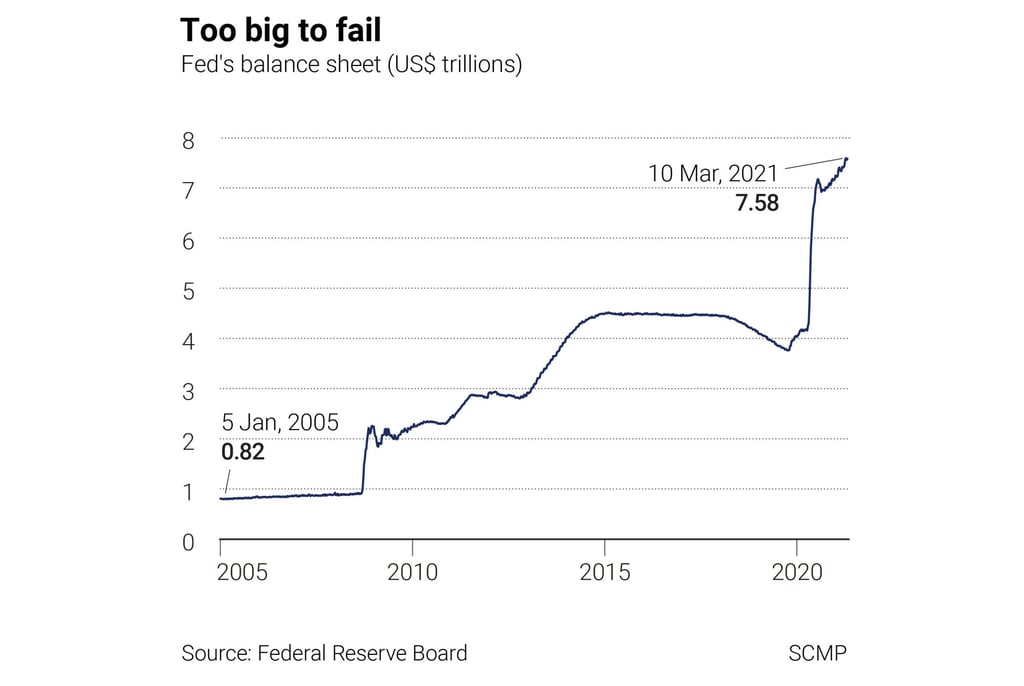

The amounts involved are mind-boggling. Since the pandemic first struck in early 2020, the IMF reckons global fiscal actions have amounted to US$12 trillion while central banks have pumped up their balance sheets by US$7.5 trillion. This has kept global recession from the door, but governments are kicking the can down the road on when it is all going to be paid back.

The US government may be reflating the country’s recovery and indirectly boosting the world economy with its proposed US$1.9 trillion stimulus package, but it all has to be repaid at some stage in the future. US federal debt is already running close to 130 per cent of gross domestic product, more than double the level outstanding before the 2008 crash.

Advertisement

Advertisement

Select Voice

Choose your listening speed

Get through articles 2x faster

1.25x

250 WPM

Slow

Average

Fast

1.25x