Macroscope | Should Germany follow China’s ‘dual circulation’ strategy?

- Beijing has ample scope to achieve 6 per cent growth in the coming years, but Germany, dependent on trade with its European Union partners, has poorer prospects

- Germany could take its cue from China’s new gambit to turn inwards and focus on domestic-led recovery to thrive

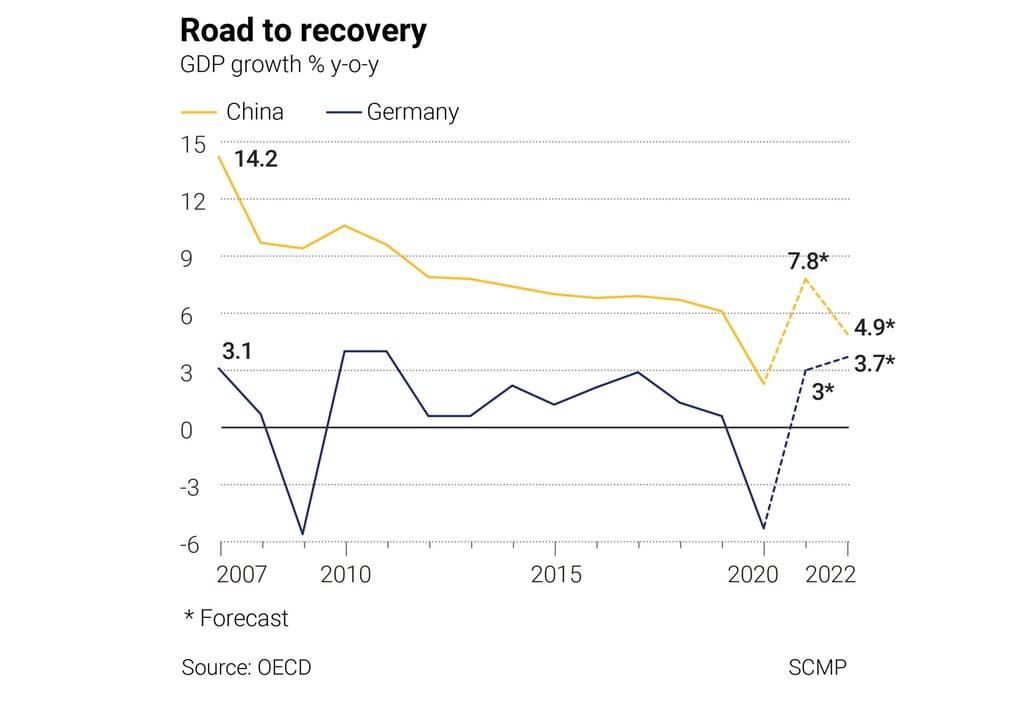

The world is in catch-up mode right now, but the key question is whether stronger recovery will be sustainable beyond 2021. China is turning its policy bias inwards towards greater domestic-driven growth, but Germany’s economy is still too dependent on its export-led growth model and vulnerable to a number of outstanding risk factors. Beyond 2021, we could see some marked divergence between these two manufacturing powerhouses.

As leading exporters, China and Germany have a clear head start. March forecasts from the Organisation for Economic Co-operation and Development expect global growth to reach 5.6 per cent in 2021, with China hitting 7.8 per cent and Germany growing more modestly by 3 per cent. Faster export recovery will be the driver, especially for China where exports surged by 60.6 per cent for the January-February period compared with a year ago.