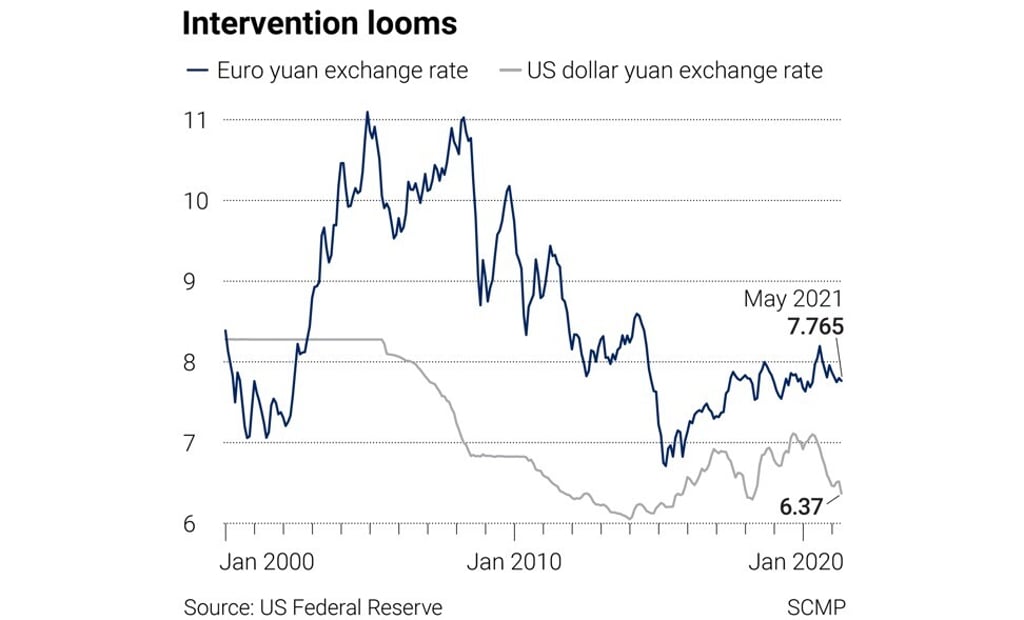

How long will the Chinese yuan continue to rise against the US dollar before Beijing intervenes?

- While currency traders have latched onto the yuan’s large interest rate premium as a sure-fire bet, the joyride won’t last forever

- The key issue is how long it will be before Beijing steps in and exercises some restraint

Currency traders have latched onto the yuan’s large interest rate premium as a sure-fire bet, but there is a catch. The joyride won’t last forever and the key issue is how long it will be before Beijing steps in and exercises some restraint.

With the currency already running at three-year highs against the US dollar, the risk of intervention by the authorities must be mounting. If the market gets the bit between its teeth, momentum could soon build for a move towards 6 yuan against the US dollar, a level that nearly traded in January 2014 when the exchange rate reached a low of 6.04 yuan.

The trouble is that China’s rock solid economic fundamentals are hard to ignore, with relative growth, interest rate and bond yield differentials all heavily weighted in the renminbi’s favour. They maintain a lot of pulling power.