Advertisement

From towering debt to bitcoin’s boom, why 2021 is the year of living dangerously

- Vaccination is unshackling major developed economies and money is flowing into real economies, sparking overheating and inflation

- This may spell the end of the speculative boom in both traditional financial markets and new products like cryptocurrencies and NFTs

4-MIN READ4-MIN

9

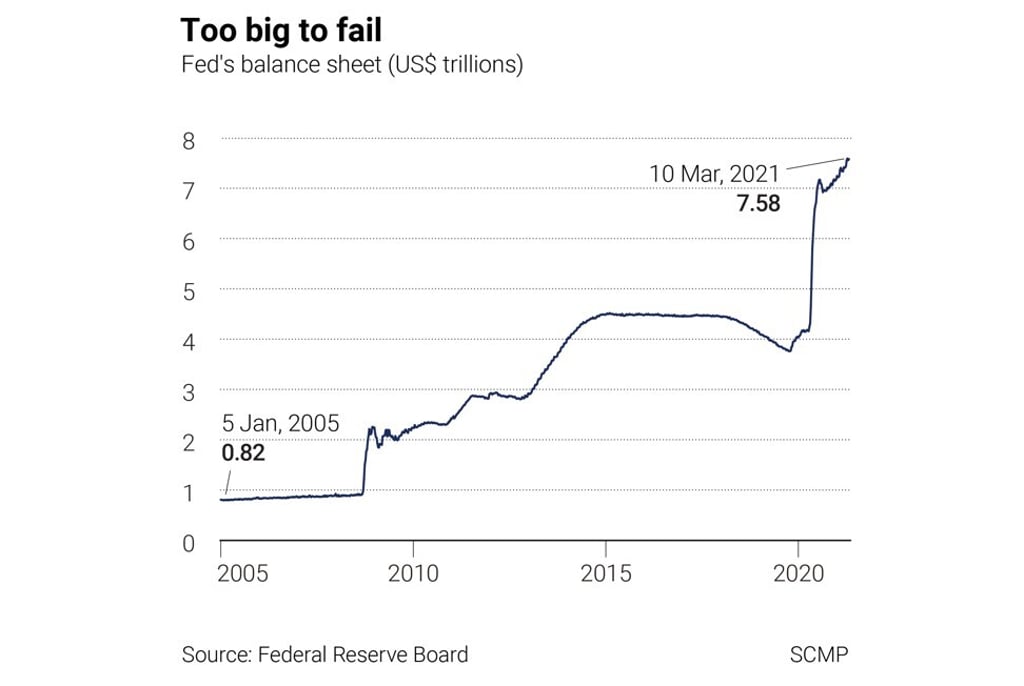

In 2020, four major central banks added US$7.8 trillion in quantitative easing and, according to the Institute for International Finance (IIF), governments of the top 61 major economies expanded debt to 105 per cent of gross domestic product – from 88 per cent in 2019 – an increase of US$12 trillion, in response to the Covid-19 pandemic.

As the Covid-19-constrained economies couldn’t respond to the stimulus, the massive injection of funds largely went into financial markets and sparked a speculative frenzy.

With vaccination unshackling major developed economies, money is flowing into real economies, sparking overheating and inflation, which may prompt some tapering of the Covid-19 stimulus.

Advertisement

Financial markets could face the double whammy of funds being diverted away from speculation to the real economy, combined with diminishing aggregate money supply. It’s clear 2021 is the year of living dangerously.

Advertisement

Governments around the world have made a colossal mistake in their handling of the economic consequences of the pandemic. It has short-circuited normal consumption and production activities. Stimulus couldn’t cure that. Instead, the massive monetary and fiscal stimulus showed up in financial markets.

Advertisement

Select Voice

Select Speed

1.00x