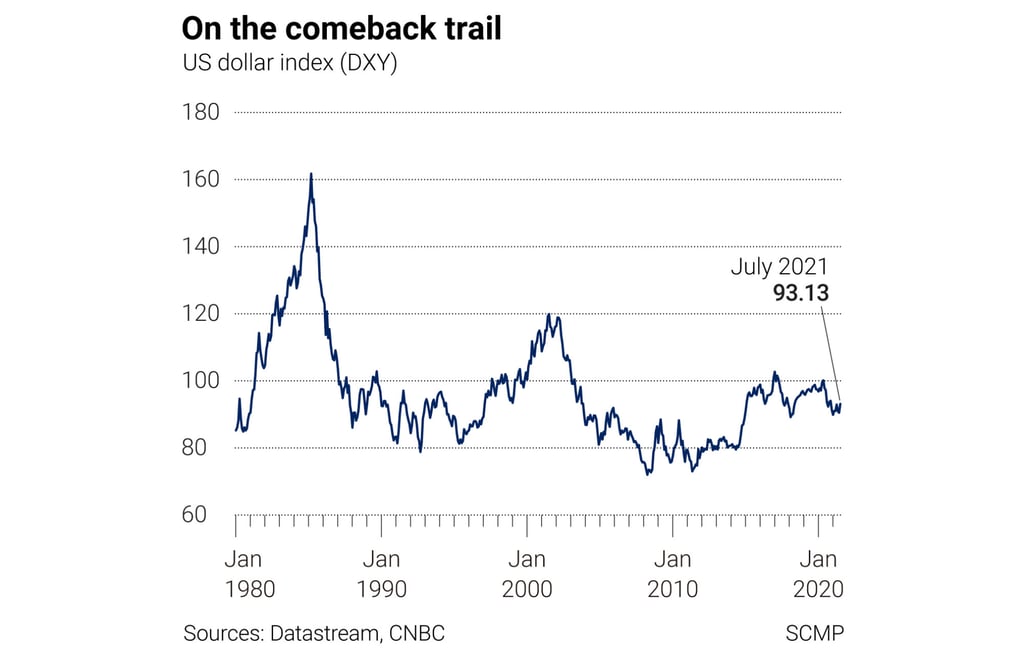

Macroscope | Why the US dollar will remain on the comeback trail for many months

- While the dollar outlook has been cloudy in the recent years, it is fighting back, thanks to tougher interest rate tightening expected from the Fed and a brighter political climate under US President Joe Biden

It’s no surprise the US dollar index against a basket of major currencies recently hit a three-month high. The dollar should remain on the comeback trail for many more months to come.

It’s already boosting recovery expectations and reviving the US job market, generally perceived as a lagging indicator of economic well-being. US employment payrolls rose 850,000 in June, beating the 700,000 forecast, with the unemployment rate unexpectedly rising to 5.9 per cent from 5.8 per cent, a positive sign though, considering that more people were seeking work and now being counted among the jobless.

It’s no surprise that recovery expectations are riding high with the US growth rate expected to reach 6.9 per cent this year, according to forecasts from the Organisation for Economic Cooperation and Development. This compares more favourably than the 2021 growth forecasts of 4.3 per cent for the euro zone and 2.6 per cent for Japan, although China is expected to come through stronger at 8.5 per cent growth.

It’s why global investors remain so upbeat about the outlook for US equity markets this year as the US economy returns to better health. US growth momentum is expected to carry through to an above average 3.6 per cent expansion rate in 2022. Overseas demand for the US equity rally should exert major pulling power in the dollar’s favour this year.