Advertisement

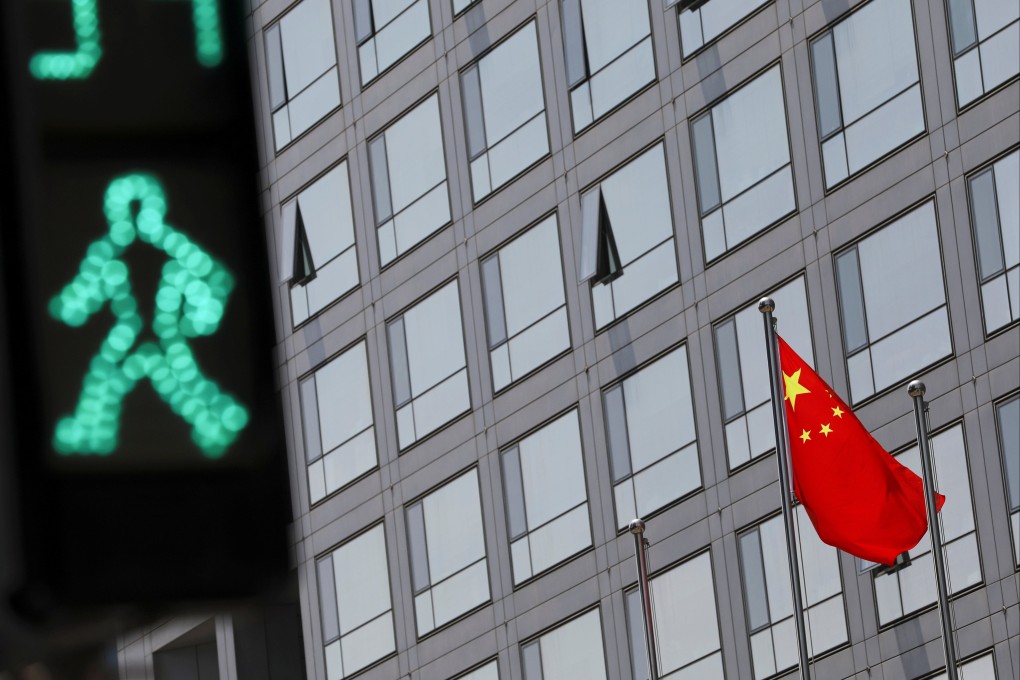

Macroscope | Why US business expansion is powering ahead in China, despite tensions

- Major US financial institutions are expanding in China, despite strained US-China relations and Beijing’s tightened control over the economy

- And, whatever their differences, both Washington and Beijing seem to welcome the expansion efforts

Reading Time:3 minutes

Why you can trust SCMP

1

US-China relations remain strained. Beijing has every intention of further extending regulatory control over key sectors of the economy. This might appear an inhospitable environment for Western investors. But the bottom line for them, when it comes to China, is that the chance to enhance the bottom line will always prevail.

Given the extent of policy differences between Beijing and Washington, it might seem generous to merely characterise US-China relations as disharmonious.

Just last week, it was revealed that US Defence Secretary Lloyd Austin had still not been able to speak to his Chinese counterpart.

Advertisement

A diplomatic compromise may well be devised to solve this specific problem but it is a lot harder to see how China and the United States will be able to bridge the gap over events in Hong Kong and Xinjiang, let alone Taiwan. But political differences aside, business is business and major US firms continue to look to expand in China.

On August 6, leading US bank JPMorgan Chase became the first foreign firm to gain approval from the China Securities Regulatory Commission (CSRC) to take 100 per cent control of its securities joint venture on the mainland, the US firm having previously increased its stake in the business to 71 per cent in November.

Advertisement

Advertisement

Select Voice

Select Speed

1.00x