Advertisement

Macroscope | Investor reactions to China’s Big Tech crackdown smack of double standards

- Billions of dollars have been wiped off the equity market value of Chinese tech firms in recent weeks in reaction to Beijing’s regulatory changes

- Yet, markets have shrugged off US President Joe Biden’s executive order cracking down on anticompetitive practices in tech

Reading Time:3 minutes

Why you can trust SCMP

4

China’s efforts to extend regulatory control over a number of business sectors may have hit a raw nerve with equity markets, prompting material markdowns in affected share prices, but investors should not overreact. Beijing’s approach might be robust but it isn’t that far removed from the way Western governments are addressing similar issues.

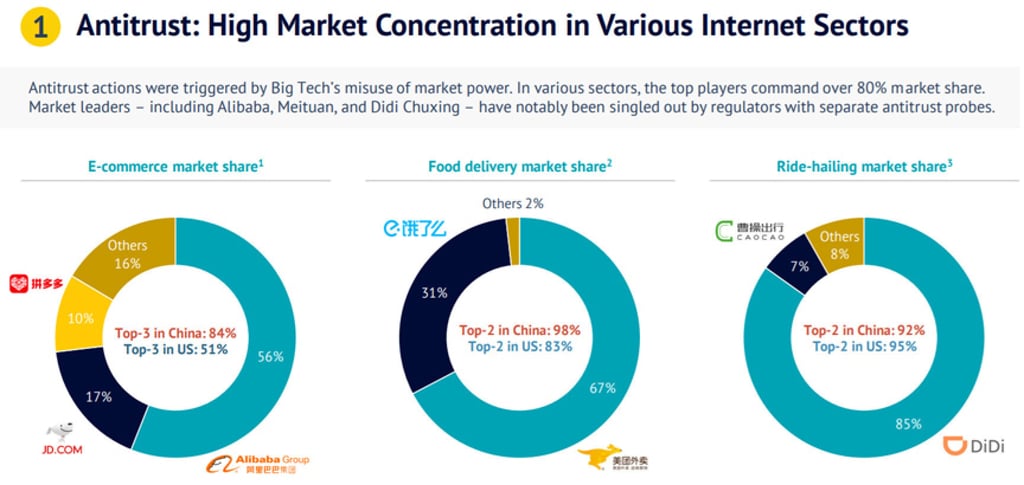

Large technology companies, Big Tech, are a case in point. Hundreds of billions of US dollars have been wiped off the equity market values of companies such as Alibaba, the e-commerce colossus and owner of the Post, and the internet giant Tencent Holdings as investors have taken fright at efforts by Beijing to establish greater regulatory oversight of such firms and moves to eliminate certain practices that the authorities now feel are restrictive.

In the past, for example, Beijing allowed China’s internet companies to develop business models incorporating “walled gardens”, where big firms built barriers around their platforms, but the Ministry of Industry and Information Technology now wants those walls dismantled.

Advertisement

Addressing the blocking of website links “is one of the priority issues of our campaign, and ensuring normal access to legitimate websites is a basic requirement for the development of the internet”, said Zhao Zhiguo, the ministry’s spokesman and director general of its Information and Communications Management Bureau, last week.

Having spent years developing business models that incorporated the walled garden approach, the firms – and investors who have bought into those business models – might not be too enthusiastic about making changes. However, there will surely be popular support from Chinese internet users for the ministry’s efforts.

The sensitivity of China Big Tech equity prices to Beijing’s regulatory roll-out partly reflects a narrative that portrays China’s moves as being part of a wider Chinese Communist Party agenda to assert greater control over critical sectors of the economy. Such control threatens business models which Beijing had previously seemed happy with, and which had consequently attracted substantive capital investment, often from overseas.

Advertisement

Select Voice

Choose your listening speed

Get through articles 2x faster

1.25x

250 WPM

Slow

Average

Fast

1.25x