Macroscope | Beyond the Evergrande crisis: why China still has strong investment appeal

- Away from the Evergrande debt crisis and the real estate sector, there are still opportunities in the industries Beijing wants to see expanded

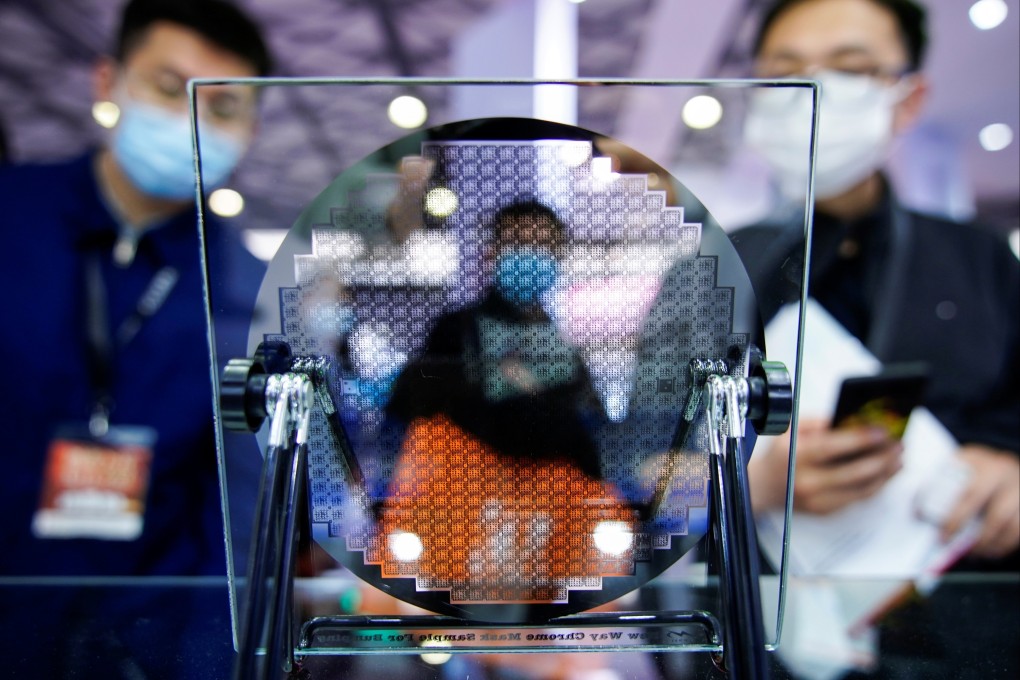

- Notably, China’s recent tech crackdown didn’t extend to industries it is championing, like semiconductors

Nor should investors view China through a Western prism. For example, while it may be tempting to draw parallels between the systemic complications that could arise from Evergrande’s situation and the seizure that the global financial system suffered after Lehman’s collapse, the temptation should be resisted.

Additionally, Lehman didn’t collapse because the US government took policy measures that rendered its business model unsustainable. It was the market perception that Lehman had become an untenable business that drove the US investment bank to the brink. US policymakers then administered the coup de grace by allowing Lehman to go bust in the mistaken belief that the ensuing damage would be containable.

Once Beijing acted on what it saw as unsustainable debt levels in the Chinese real estate market, there had to be consequences. Beijing would have expected that and, it is to be hoped, calculated that if defusing the problem was to lead to an explosion, then, unlike in the case of Lehman, it would at least be a controlled blast.