Macroscope | Why the prospects for Britain’s ‘shortage economy’ look grim

- While GDP rebounded 5.5 per cent in the second quarter, there are already signs retail activity is cooling

- A major risk is that government measures introduced to kick-start the pandemic-hit economy will be withdrawn to get public-sector finances back into shape

Some 21 months after quitting the European Union, Brexit has left the UK economy in a mess – social welfare conditions are deteriorating, the health system is under serious strain and supply-chain issues are becoming a bigger problem.

Longer-term growth prospects are deteriorating sharply with Britain being written off as the sick man of Europe. Britain’s “shortage economy” seems to be going from bad to worse, with too few bright spots on the horizon.

Last week’s autumn statement from the government was full of promise of better times ahead, but painfully short on detail about how any post-Brexit economic renaissance will happen.

On the bright side, UK growth still seems to have some positive forward momentum, with gross domestic product rebounding by 5.5 per cent in the second quarter after a 1.4 per cent drop in the first three months of 2021.

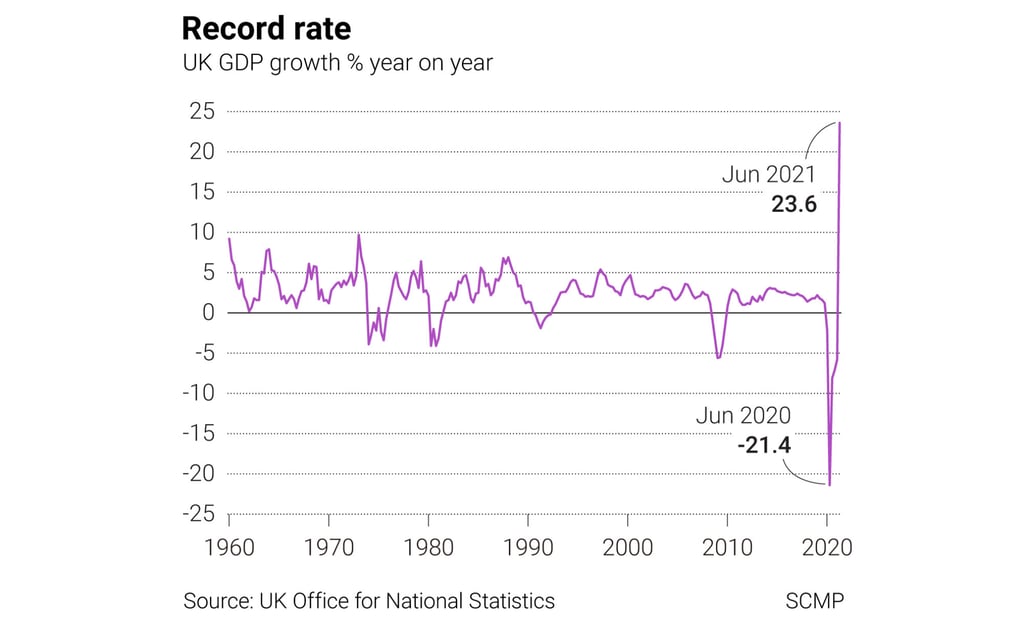

The economy expanded by 23.6 per cent year on year, a record growth rate following the easing of Covid-19 restrictions, and after a record 21.4 per cent contraction a year earlier when the Covid-19 crisis first hit the economy.

It’s no wonder the government sounds more hopeful that the economy has turned the corner, but the worry now is how durable the recovery will be.

Consumer spending, which averages around 65 per cent of GDP, received a major boost from the government’s Covid-19 relief support, but there are already signs that retail activity is cooling – retail sales were down 1.3 per cent in September from a year ago.