Advertisement

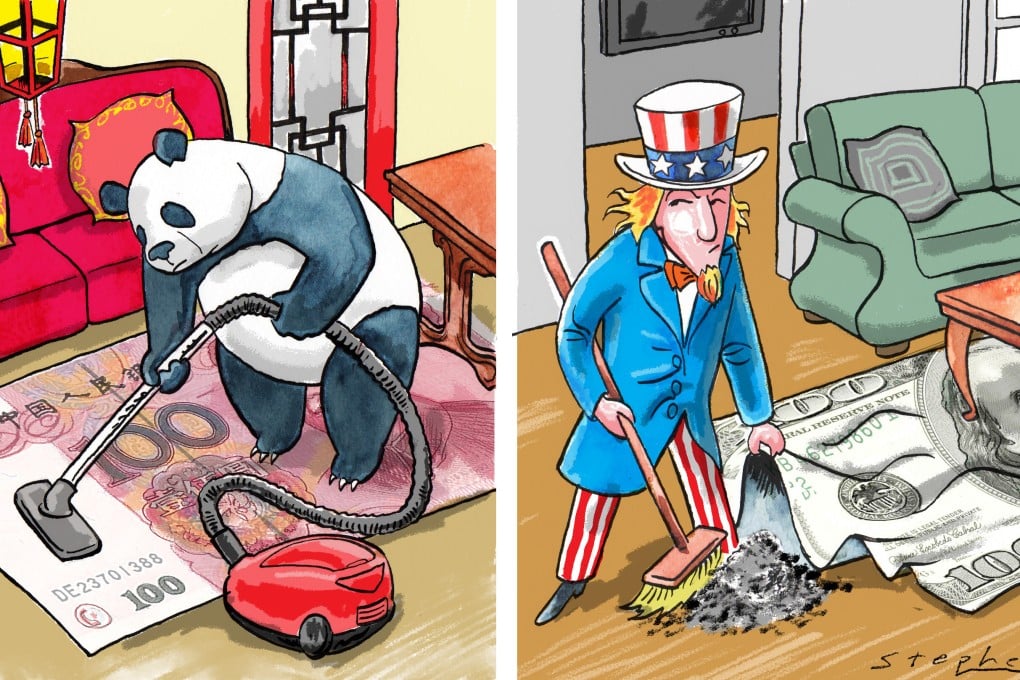

Opinion | How US inflation spiral could tip superpower rivalry in China’s favour

- China’s financial system could soon be strong enough to withstand a stronger yuan, leaving the US vulnerable to a currency shock

- Floating the renminbi could tip the US deeper into inflation and turmoil while giving Beijing free rein in international affairs

Reading Time:4 minutes

Why you can trust SCMP

22

Labour shortages, excessive stimulus and large amounts of quantitative easing are coming together to create a global inflation cycle. The US dollar-renminbi peg creates artificial currency stability, which prevents the spiral of currency devaluation and rising inflation that emerged the 1970s and allows the US Federal Reserve and other major central banks to procrastinate in their responses.

This will further entrench the inflation cycle and pile up the risks down the road. If the dollar-renminbi peg breaks – which China could bring about deliberately as a strategic move – the consequences could be catastrophic for the United States. If and when that day comes, know that the Fed is responsible.

Inflation is surging in the US, where October’s 6.2 per cent year-on-year increase in the consumer price index was the highest in 30 years. US President Joe Biden’s political fortunes are suffering as voters fret over rising prices, and strong consumer reaction in the US is likely to lead to government action.

Advertisement

The Biden administration has asked Opec members to increase oil production, but to no avail. The US said this week it would release million of barrels of oil from its reserves, along with China, India, South Korea, Japan and Britain, in an attempt to bring down soaring energy and petrol prices.

The Fed, on the other hand, is sticking to its story that inflation is transitory, blaming supply chain disruptions such as congestion at ports and a lack of workers.

Advertisement

The Fed could soon start to further taper its monthly asset purchases, which are one of the primary drivers of current inflation levels. This quantitative easing is already baked into buoyant asset prices, though, and could trigger a sharper correction than in September 2019.

Advertisement

Select Voice

Select Speed

1.00x