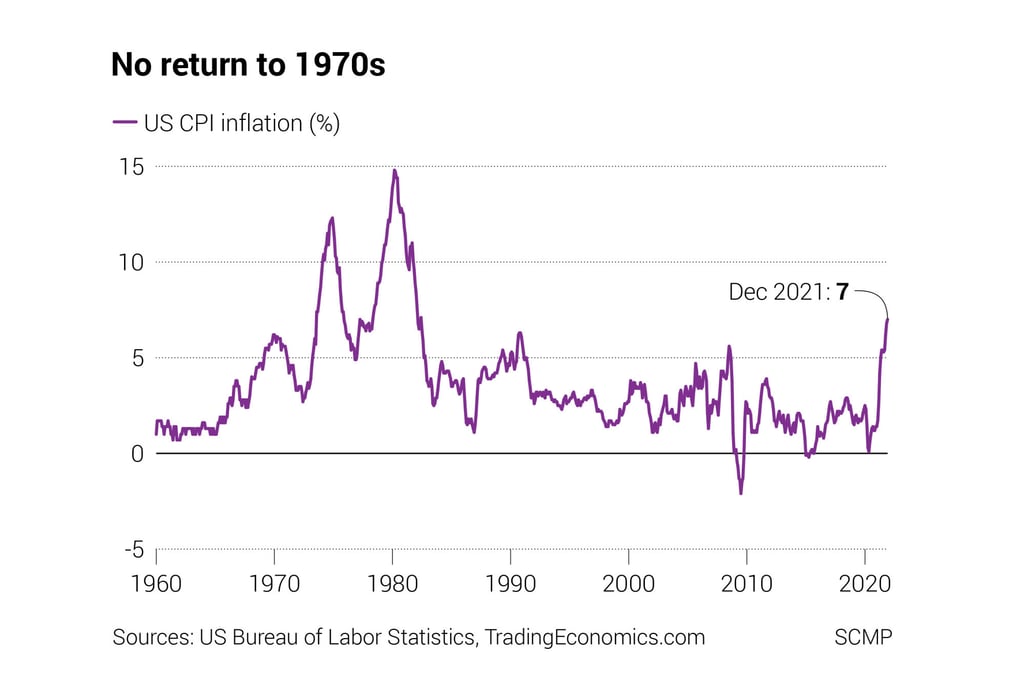

Macroscope | The US Federal Reserve can’t risk a return to the high inflation of the 1970s and 1980s

- Niggling fears over economic growth remain but with supply chain constraints still severe and energy prices that could spiral upwards under the threat of war in Ukraine, the Fed is right to raise interest rates as soon as possible

It is any central banker’s worst nightmare – wondering whether their monetary actions may have whipped up a storm of needless inflation risks. With global interest rates so low and the world economy on a robust recovery, it’s no wonder markets are so concerned that we may be heading back to the bad old days of high inflation seen in the 1970s and 1980s.

There is no easy answer to where interest rates should be right now. We may not be heading into a hyperinflation catastrophe, but the old hype about the end of inflation now looks wildly premature. Inflation is coming back, interest rates are heading higher and the world just has to get used to it.

In the Fed’s view, the odds are shifting towards inflation becoming more entrenched rather than transitory, especially with employment prospects bouncing back.